Advertisement|Remove ads.

Nvidia Q4 Earnings Expected To Skyrocket As Wall Street Expects AI Boom To Continue: Retail Thinks AI Bellwether Will Save The Market

AI bellwether Nvidia Corp.’s (NVDA) shares rose nearly 1.5% in after-market hours on Tuesday as the company’s fourth-quarter earnings are expected to surge by an impressive 63% year-on-year (YoY).

Nvidia is expected to report earnings per share (EPS) of $0.85 during Q4, up from $0.52 in the same period last year, implying a 63% surge.

Revenue is estimated to be $38.1 billion, up an impressive 72% year over year from $22.1 billion during the same period last year.

Fueling Nvidia’s top and bottom lines will be the artificial intelligence (AI) boom, driving demand for the company’s graphics processing units (GPU).

This is at a time when DeepSeek-related concerns led to market turmoil, wiping out $1 trillion in market capitalization of U.S.-listed equities in January.

However, analysts at Baird dismissed the potential of an adverse impact on demand for Nvidia’s top-end GB200 chips.

In a recent note to their clients, Baird analysts said that GB200 demand is gaining momentum, and the delays were due to data center availability and architecture-specific novelties, leading to extra time consumed in implementing and optimizing servers, according to The Fly.

The brokerage has an ‘Outperform’ rating on the stock with a price target of $195, implying an upside of 54% from Tuesday’s closing price.

FinChat data shows Nvidia stock has an average price target of $171.64, which implies a 35% upside from current levels. Of the 66 brokerage recommendations, there are 45 ‘Buy’ ratings and 11 ‘Outperform’ ratings, while four suggest ‘Hold’ and seven have no opinion.

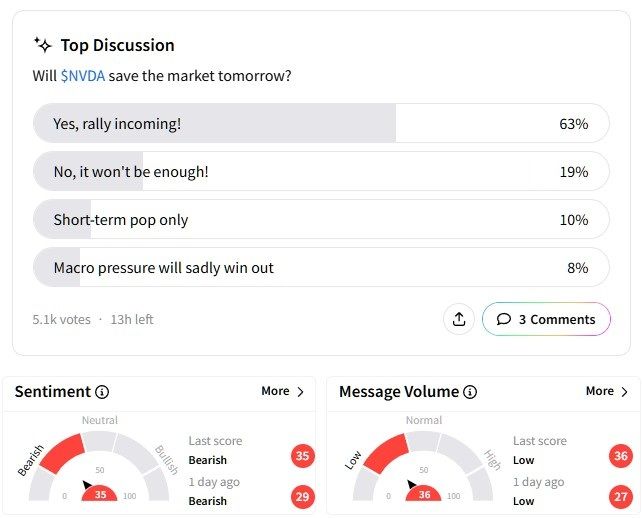

Retail sentiment on Stocktwits showed a divergence from the broader consensus on Wall Street, with investors feeling ‘bearish’ at the time of writing.

However, a Stocktwits poll of over 5,100 users shows that 63% of the respondents think Nvidia’s Q4 earnings will “save the market” on Wednesday and that there could be a rally in the stock.

One user thinks bears will get “fried” this week.

Another user wondered if Nvidia’s stock could touch the $170 mark this week.

Nvidia’s stock has performed worse than the Nasdaq Composite index year-to-date (YTD) – it is down 5.7%, while Nasdaq fell only 1.5%.

Over the past year, Nvidia’s stock is up 60%, while Nasdaq has delivered 19% returns during this period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)