Advertisement|Remove ads.

Nvidia Reclaims Market Cap Crown From Microsoft As AI Mania Persists; Retail Stays Bullish

Nvidia Corp. (NVDA) rallied 2.80% on Tuesday amid a rally in tech stocks as traders factored in a potential resolution of the tariff crisis and remained upbeat about the Jensen Huang-led company’s fundamentals.

Also buoying sentiment was Jefferies's addition of Nvidia to its “Franchise Picks,” which are the brokerage's “highest-conviction, buy-rated” stocks.

The stock also received support from Meta Platforms’ 20-year nuclear energy deal to power its Illinois data centers, which underlined the technology’s extended runway.

The artificial intelligence (AI) stalwart’s stock closed Tuesday’s session at $141.22, giving it a market cap of $3.444 trillion. The gain helped Nvidia unseat Microsoft (MSFT) from the pole position, as the latter clocked a more modest 0.22% gain and ended with a valuation of $3.441 trillion.

Since June last year, Nvidia, Apple (AAPL), and Microsoft have taken turns holding the title of the world’s most valuable company. Nvidia last held the top slot in January, when its shares reached a record high of $153.13 on Jan. 7.

Subsequently, the shares came under pressure, dragged by the broader market weakness and President Donald Trump’s tariffs. The Trump administration also imposed additional China chip export restrictions, which weighed on the stock.

After these developments, Nvidia stock returned to a low of $86.62 on April 7. Since then, the stock has been on the mend, as traders cheered a few bilateral trade deals struck by the U.S. and Nvidia’s solid quarterly results despite the China headwinds.

Chart courtesy of TradingView

Nvidia is in the sweet spot of the AI revolution, which has taken a firm hold. Its advanced high-performance computing chips power most of the world’s AI applications and systems.

Recently, the company announced multi-billion-dollar trade deals in the Middle East and showcased its AI infrastructure strategy at the Computex expo held in Taiwan.

Huang now considers sovereign AI the company’s key focus area.

Sell-side analysts are optimistic about the stock’s trajectory. The Koyfin-compiled consensus price target for Nvidia stock is $170.76, implying an upside potential of over 20% in the next 12 months.

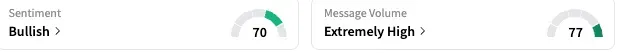

On Stocktwits, retail sentiment toward the Nvidia stock was ‘bullish’ (70/100) by late Tuesday and the message volume was ‘extremely high.’

A bullish user said Nvidia stock will be around $400 over the next year despite the lingering headwinds.

Nvidia stock has gained over 5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)