Advertisement|Remove ads.

Nvidia Stock Rises As HP Ships First Grace Blackwell System, Mizuho Sees Robust Uptake In H2 2025: Retail Remains Bearish

Shares of Nvidia Corp. (NVDA) rose in mid-day trade by over 3% as Hewlett Packard Enterprise Co. (HPE) announced the shipment of its first Grace Blackwell system.

HP’s new Blackwell system is aimed at allowing service providers and large enterprises to quickly deploy complex artificial intelligence (AI) models.

According to the company, it comes with a cooling solution to improve efficiency and optimize performance.

“Engineers, scientists, and researchers need cutting-edge liquid cooling technology to keep up with increasing power and compute requirements,” said Bob Pette, vice president of enterprise platforms at Nvidia.

HPE’s Grace Blackwell rack consists of 72 Nvidia Blackwell graphics processing units (GPU), and 36 Nvidia Grace central processing units (CPU).

While Nvidia’s latest Blackwell chip is currently encountering an overheating problem, analysts at Mizuho expressed optimism that after slightly flat growth in the second quarter (Q2), Blackwell shipments should see robust uptake in the second half of the year, according to a report by Investing.com.

“Our checks indicate that while JanQ DC is expected in-line, AprQ could be more flattish as near-term ramps remain modest given GB200 (120KW per rack) power/ cooling requirements and more HGX/MGX mix,” the brokerage said in a recent note.

Mizuho has a price target of $175 on the Nvidia stock, implying an upside of nearly 30% from current levels. The brokerage maintained its ‘Outperform’ rating for Nvidia.

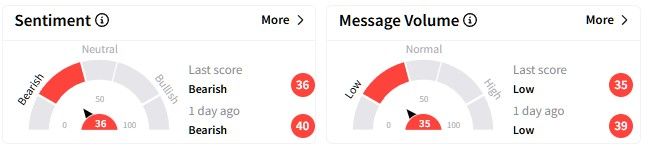

On Stocktwits, retail sentiment around the Nvidia stock remained in the ‘bearish’ (36/100) territory, worsening from a day ago.

One user said they are buying puts on the Nvidia stock, expressing their bearish outlook.

Nvidia’s stock has gained a little over 16% in the past six months amid increased volatility.

However, its one-year performance is stellar, with gains of over 87%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)