Advertisement|Remove ads.

Nvidia Stock Set For ‘Big Breakout’ Rally? Most Retail Traders Are All-In Ahead Of Earnings Next Week

Artificial intelligence stalwart Nvidia Corp. (NVDA) shares have staged a nice recovery since hitting a bottom of $92.11 hit on April 4 in the aftermath of President Donald Trump’s reciprocal tariffs.

The next big catalyst for Nvidia is its quarterly results, which are due after the market closes on May 28. The Finchat-compiled consensus estimates call for adjusted earnings per share (EPS) of $0.75 and revenue of $43.18 billion for the first quarter of the fiscal year 2026.

This marks an increase from the year-ago quarter’s $0.61 and $26.04 billion, respectively.

In late February, Nvidia had guided to revenue of $43 billion, plus or minus 2% for the first quarter, but since then, it has disclosed $5.5 billion in charges related to China chip export curbs.

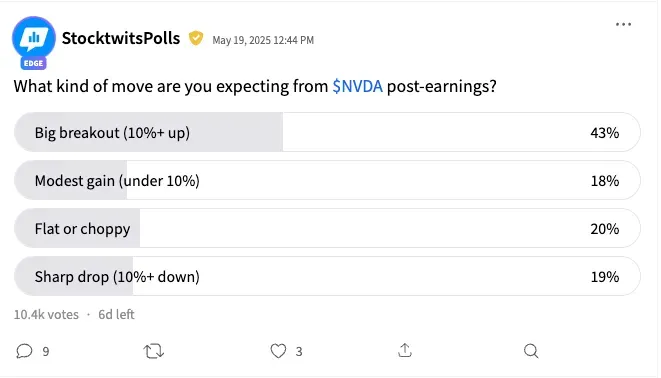

An ongoing Stocktwits poll that has received responses from over 10,000 users found that most retail investors (61%) were bracing for a rally in Nvidia stock after earnings.

Of these, 43% expected a big breakout (an over 10% gain), while 18% predicted gains less than 10%.

One-fifth of the respondents (20%) expected flat or choppy trading, while nearly as many (19%) factored in a sharp drop, defined as 10% or more.

A bullish user who commented on the poll smelt “huge opportunity” for Nvidia as an AI infrastructure company, given everything that was announced earlier this week at the Computex expo in Taiwan.

Another user called Nvidia “the company of the century” and said it was undervalued.

A third user expected a run-up ahead of the earnings and an immediate crash after the event, but sees the stock grinding its way back up again for the rest of the year.

In Thursday’s early premarket session, Nvidia stock rose 0.67% to $132.69, recovering from Wednesday’s nearly 2% pullback. The stock is down 1.9% this year and a steeper 14% from its Jan. 7 record high of $153.13.

The Koyfin-compilled consensus price target for the Nvidia stock is $163, implying nearly 24% upside potential from Wednesday’s close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Bitcoin Smashes $111,000 As Record Rally Rolls On — And Retail Traders Can’t Get Enough

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)