Advertisement|Remove ads.

Nvidia Upgraded To Buy By DA Davidson As AI Demand Accelerates: Retail Says Stock ‘Significantly Undervalued’

Nvidia Corp. (NVDA) shares received an upgrade from D.A. Davidson, which lifted its rating on the stock from ‘Neutral’ to ‘Buy’ and increased its price target to $210, up from $195.

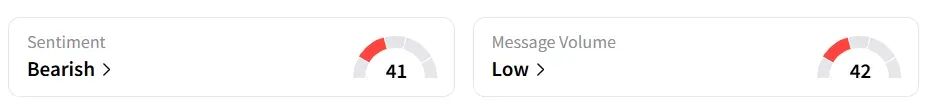

The firm’s upgraded stance is based on the growing confidence that demand for AI computing will remain strong well into 2026 and beyond. Nvidia stock inched 0.03% lower on Thursday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

A bullish Stocktwits user said the stock is ‘significantly undervalued’.

The firm stated that the surging appetite for AI-driven compute capacity outweighs prior concerns about rising competition and regional demand risks. DA Davidson's reassessment is based on the belief that Nvidia is positioned to benefit from an extended wave of AI infrastructure investment.

While the firm had previously expressed reservations regarding custom chips developed by customers, such as Alphabet Inc.’s (GOOG, GOOGL) Tensor Processing Units (TPUs), and uncertainties in the Chinese market, those worries now take a back seat to the expected growth in AI-related computing needs.

As generative AI applications expand across industries, Nvidia’s GPUs remain central to data center buildouts and AI model training, positioning the company at the forefront of the ongoing transformation in technology.

For the second quarter of fiscal 2026, the chip giant reported a revenue of $46.74 billion and earnings per share (EPS) of $1.01, surpassing the analyst’s consensus estimate of $66.91 billion, according to Fiscal AI data.

Nvidia’s shares have gained 32% year-to-date and over 51% in the last 12 months.

Also See: Next Technology Rocketed 38% Today – Here’s What Retail Investors Feel About The Stock

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_chart_trending_march_jpg_ad3a86ed42.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novo_nordisk_resized_ebdb16c103.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239888469_jpg_5e0e3b606c.webp)