Advertisement|Remove ads.

NXP Semiconductors Stock Drags Ahead Of Q4 Earnings: Analysts Point To ‘Choppy’ Recovery On Uncertain Demand, But Retail Sentiment Soars

Shares of NXP Semiconductors NV (NXPI) were in focus on Monday ahead of the company’s fourth-quarter earnings scheduled to be announced during after-market hours.

NXP stock was down nearly 2% during mid-day trade as investors processed the ongoing tariff battle between the U.S. and some of its largest trading partners, including China, Canada, and Mexico.

While President Donald Trump announced a pause on Mexico tariffs for a month amid ongoing discussions with his Mexican counterpart, the broader market sentiment remained on edge.

The NXP stock price was down nearly 1.5%, whereas the Nasdaq 100 index was down nearly 0.8%, recovering from the day’s low of a 2.25% fall.

Earlier in January, analysts at Susquehanna and Barclays reduced their price targets for the NXP stock, according to TheFly.

The underlying thesis for the reduction was a “choppy” broad-based recovery due to uncertain demand and uneven inventory progress.

While Susquehanna has a price target of $235, Barclays analysts have it set at $230 – this still implies an upside in the range of 12% to 14%, based on current price levels.

According to Stocktwits data, NXP Semiconductors is expected to post earnings per share (EPS) of $3.16, down more than 13% year over year.

Its revenue is expected to come in at $3.12 billion, down more than 8% year-on-year.

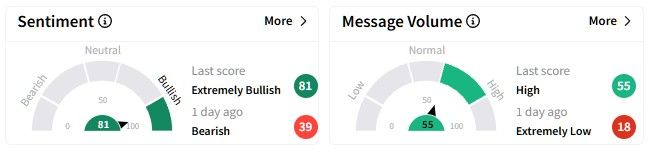

Despite the cautious sentiment among analysts, the retail mood remained upbeat on Stocktwits, rising to ‘extremely bullish’ (80/100) territory from ‘bearish’ a day ago. This was accompanied by a surge in chatter ahead of Monday’s earnings.

One user on the platform has a price target of $240.

NXP Semiconductors’ stock price has been on a downward path recently, falling nearly 13% over the past six months. Its performance over the past year has been relatively better, with a decline of a little over 7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)