Advertisement|Remove ads.

MicroStrategy Stock Recovers From Morning Dip After Firm Skips BTC Purchase Ahead Of Earnings: Retail Remains Bearish

Shares of MicroStrategy Inc. (MSTR) recovered from early morning lows after the Michael Saylor-led company announced that it had not made any fresh Bitcoin (BTC) purchases over the past week.

Although no reason was attributed, reports speculate the company’s upcoming earnings report to be one of the factors.

MicroStrategy is scheduled to announce its fourth-quarter earnings on Wednesday. According to Stocktwits data, the Bitcoin proxy is expected to post a loss per share (EPS) of $0.09, with revenue of $122.45 million.

Despite the recovery, MicroStrategy’s share price was down 1% at the time of writing. The company’s stock opened 7% in the red as President Donald Trump’s tariffs spooked markets, resulting in a broader downtrend across sectors.

In a filing with the U.S. Securities and Exchange Commission (SEC), MicroStrategy noted that its Bitcoin holdings stand at 471,107, with a purchase price of $30.4 billion and an average price of $64,511 per Bitcoin.

Based on current prices, MicroStrategy’s Bitcoin holdings are worth $46.65 billion, with an unrealized gain of over 54%.

While Bitcoin eventually recovered, other major cryptocurrencies were still reeling from the aftershocks of Trump’s tariffs on the U.S.’s three most significant trading partners: China, Canada, and Mexico.

At the time of writing, Ethereum (ETH) was down more than 11% over the past 24 hours, according to CoinGecko, while XRP was down over 3.6%, and Dogecoin (DOGE) was down nearly 5%.

Over the past seven days, Bitcoin prices have traded sideways – the apex crypto is down 0.8% during this period, while MicroStrategy’s stock price has fallen by over 4%.

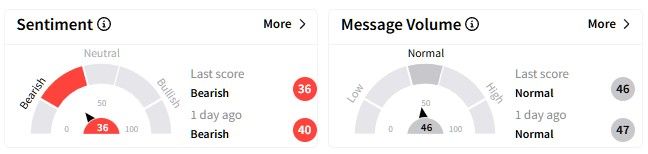

On Stocktwits, retail sentiment surrounding MicroStrategy stock was decidedly ‘bearish’ (36/100), worsening from a day ago.

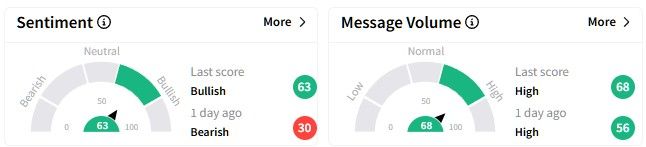

On the other hand, retail users remained optimistic about Bitcoin, with the sentiment climbing into the ‘bullish’ (63/100) territory from ‘bearish’ a day ago.

One user posted a technical analysis of the MicroStrategy stock, noting that while it has recovered, it feels “super weak” at this point.

MicroStrategy stock has more than doubled over the past six months, gaining 155%. Its one-year returns stand at a whopping 581%.

Conversely, Bitcoin has registered gains of more than 60% over the past six months and 130% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Cloudflare Stock Dips On Baird Downgrade Flagging Overvaluation: Retail Shrugs It Off

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)