Advertisement|Remove ads.

Oklo, Vistra, Constellation Energy Stocks Sink As China’s DeepSeek AI Launch Sparks Concerns: Retail Investors Spooked

Shares of several energy stocks, including OpenAI co-founder Sam Altman-backed Oklo Inc. (OKLO), Constellation Energy Corp. (CEG), and Vistra Corp. (VST), among others, plunged in mid-day trade on Monday.

While the broader S&P 500 index is down nearly 2%, the S&P Energy index is down almost 1.4%.

Oklo’s stock price plunged almost 29%, Vistra’s share price was down 28%, and Constellation Energy’s share price declined almost 20% at the time of writing.

This comes amid a broader selloff across the technology sector, especially in the semiconductor industry, with Nvidia Corp. (NVDA) tumbling over 15%.

According to a report by TheFly, BMO Capital highlighted in its latest note that DeepSeek’s AI model could require between 50% to 75% less power than other large language models using Nvidia’s latest graphics processing units (GPU).

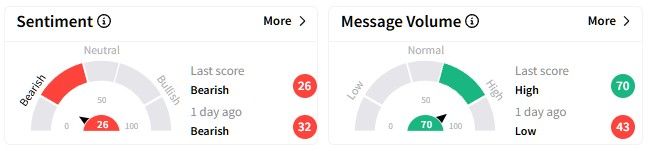

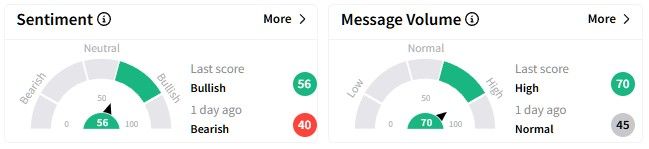

Retail sentiment on Stocktwits mirrored the fear among the wider investor base.

Constellation Energy’s sentiment meter on Stocktwits worsened, hovering in the ‘extremely bearish’ (28/100) territory.

Constellation Energy’s shares have gained over 60%, while they have surged nearly 129% over the past year.

Vistra’s sentiment meter was far worse in the ‘extremely bearish’ (6/100), lowest over the past year, falling from ‘bearish’ (41/100) territory.

Vistra’s stock has nearly doubled over the past six months, gaining over 90%, while its one-year return stands at 234%.

On the other hand, Oklo’s sentiment meter was in the ‘bullish’ (55/100) territory.

Users expressed mixed sentiments on the platform.

Oklo’s stock price has gained 30% in the past six months, while its one-year gains stand at 161%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)