Advertisement|Remove ads.

Ollie’s Bargain Stock Falls Ahead Of Q4 Earnings, But Retail’s Bullish

Shares of closeout store Ollie’s Bargain Outlet Holdings Inc. have fallen 6.9% in the past month, even as the retailer received a price target hike ahead of its fourth-quarter results, with retail sentiment upbeat.

Ollie’s is set to report Q4 results before the market opens on Wednesday.

Wall Street analysts expect the company to post a 30% increase in revenue to $674.5 million and a 106% rise in earnings per share to $1.19 for the fourth quarter, according to Koyfin.

Ollie’s has beaten EPS estimates thrice in the past four quarters and revenue twice in the same period.

It recently announced the acquisition of 40 former Big Lots store leases from Gordon Brothers, eventually leading to RBC Capital raising its price target to $133 from $130 and with an Outperform rating.

The firm's model is largely unchanged outside of revising its unit and pre-opening expense estimates and is positive on the stock's risk-reward given its "strong" underlying fundamentals, said the report.

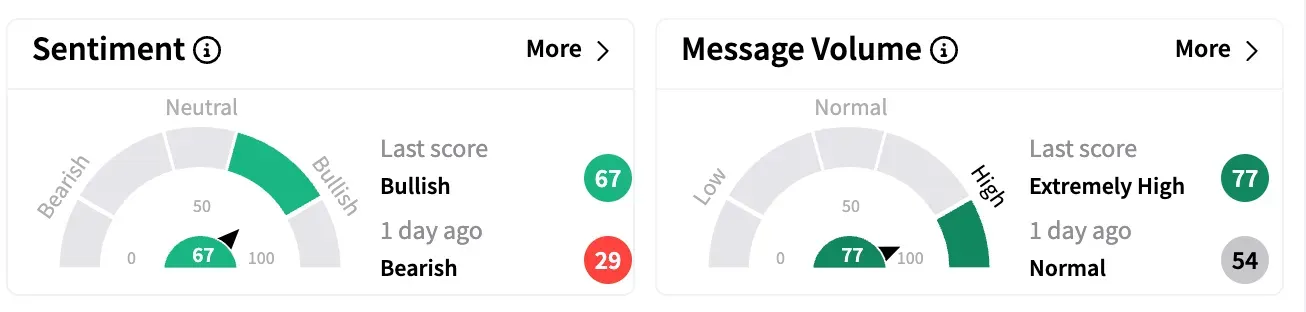

Sentiment on Stocktwits ended on a ‘bullish’ note on Tuesday compared to ‘bearish’ a day ago. Message volume climbed to ‘extremely high’ levels.

"Taking a gamble with $OLLI after the drop today. $110 calls," wrote one user.

In February, the company received a downgrade from Jefferies, which cut the rating to ‘Hold’ from ‘Buy’ with a price target of $111, reduced from $125, The Fly reported.

According to the report, the brokerage warned about a storm brewing in the consumer discretionary sector as industry inventories are rising for the first time in two years.

Ollie’s Bargain stock is down 9.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)