Advertisement|Remove ads.

Oracle Grabs Wall Street Attention Amid AI Cloud Momentum Ahead Of Earnings: Retail Echoes Confidence

Oracle Corp. (ORCL) has received positive attention from Wall Street ahead of its first-quarter (Q1) fiscal 2026 earnings, with several firms raising their price targets on the stock.

The company is expected to release its Q1 results after the closing bell on September 9. Barclays boosted its target to $281 from $221 while keeping an ‘Overweight’ rating, citing the importance of the recently announced $30 billion annual recurring revenue agreement (ARR), according to TheFly.

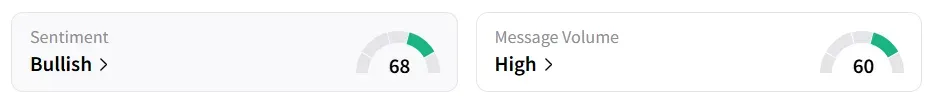

Oracle stock traded over 3% higher on Monday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory while message volume improved to ‘high’ from ‘normal’ levels in 24 hours.

The stock saw a 240% increase in user message count over the last week.

JPMorgan raised its price target to $185 from $135, maintaining a ‘Neutral’ rating. The firm pointed to strong AI infrastructure bookings and noted Oracle's healthy cloud momentum as key drivers.

Morgan Stanley also increased its price target to $246 from $175 while keeping an ‘Equal Weight’ rating. The firm suggested that Oracle may raise its FY2029 revenue goals to around $125 billion at its upcoming analyst day, although margin pressures could limit the earnings per share (EPS) outlook to between $11.50 and $12.00.

On September 5, Worker Adjustment and Retraining Notification filings with the state of California showed that the tech giant had trimmed its workforce at three of its locations in the state.

According to the Fiscal AI-compiled consensus estimates, Oracle is expected to report a Q1 earnings per share (EPS) of $1.48 and revenue of $15.03 billion, marking about 13% year-over-year (YoY) growth.

Oracle stock has gained over 44% year-to-date and 72% in the last 12 months.

Also See: Why Did Planet Labs Stock Rocket Over 35% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)