Advertisement|Remove ads.

Oracle’s Risk-Reward Seems Compelling Despite Investor Concerns, Says Jefferies

- Jefferies said Oracle is pursuing a rapid rollout of new data centers to satisfy growing demand for AI compute power.

- The firm stated that success in these initiatives could position Oracle as a central player in delivering AI workloads.

- It believes the stock offers compelling risk/reward dynamics following a recent pullback.

Jefferies has named Oracle Corp. ORCL) a top pick, citing its potential to capitalize on surging demand for AI infrastructure despite ongoing investor concerns.

According to an Investing.com report, Jefferies has reaffirmed its ‘Buy’ rating on the stock and has kept a $400 price target, implying a potential 105% upside to the stock’s closing price on Friday.

Strategic Data Center Expansion

Jefferies said Oracle is pursuing a rapid rollout of new data centers to satisfy growing demand for AI compute power. Execution of this plan, combined with the timely conversion of its $523 billion backlog into revenue, is central to the company’s strategy.

The report cited Jefferies stating that success in these initiatives could position Oracle as a central player in delivering AI workloads across hybrid and multi-cloud environments.

According to the firm, investors remain divided over the company’s ability to fund its rapid expansion without compromising financial stability. Still, it believes the stock offers compelling risk/reward dynamics following a recent pullback, with significant upside potential relative to downside risk.

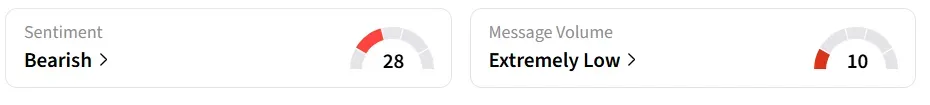

Oracle stock inched over 0.5% higher on Monday, after the opening bell. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory with ‘extremely low’ message volume levels.

Financial Performance And TikTok Deal

In its second-quarter fiscal 2026, Oracle reported a revenue of $16.1 billion, just below the $16.19 billion analysts expected, according to FiscalAI data. The revenue miss overshadowed its earnings beat, causing a sharp decline in its stock price.

Investor sentiment also turned sour after a report suggested that Oracle’s funding partner, Blue Owl Capital, withdrew from a $10 billion investment for a new AI data center facility in Michigan. The company later denied the report.

However, the company’s consecutive agreement to manage TikTok’s U.S. business was perceived as a catalyst. In December, it was announced that TikTok's U.S. operations would be transferred to a new joint venture, TikTok USDS Joint Venture LLC, with Oracle, Silver Lake, and Abu Dhabi-based MGX collectively owning a 45% stake.

ORCL stock has gained over 17% in the last 12 months.

Also See: Altimmune Receives FDA’s Breakthrough Therapy Designation For Its Liver Disease Drug

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)