Advertisement|Remove ads.

Oracle Stock Tumbles After-Hours As Q2 Earnings Beat Masked By One-Off Ampere Gain And Weak Revenue

- Revenue of $16.1 billion came in just below expectations, pressuring the stock despite strong cloud momentum.

- Earnings were lifted by a $2.7 billion pre-tax gain from the Ampere stake sale, inflating both GAAP and adjusted EPS.

- RPO surged by $68 billion sequentially as Oracle expanded its AI and multicloud datacenter footprint.

Oracle Corp. (ORCL) shares fell over 7% in after-hours trading on Wednesday after the company’s second-quarter (Q2) revenue came in slightly below expectations, overshadowing an earnings beat that was inflated by a large one-time gain.

Q2 Review

Oracle reported revenue of $16.1 billion for the quarter, just below the $16.19 billion analysts expected, according to Koyfin estimates. Adjusted earnings per share (EPS) rose 54% to $2.26, topping the $1.64 consensus, while GAAP EPS increased 91% to $2.1, ahead of the $1.17 forecast. Both figures were significantly lifted by a $2.7 billion pre-tax gain from the sale of Oracle’s stake in Ampere.

GAAP net income was $6.1 billion, and adjusted net income rose to $6.6 billion, up 57% in USD and 54% in constant currency. Oracle added that remaining performance obligations (RPO) increased by $68 billion sequentially.

Oracle’s board declared a quarterly dividend of $0.5 per share, payable on Jan. 23, 2026.

AI Expansion

Chairman and CTO Larry Ellison said the sale of Ampere reflects Oracle’s move toward “chip neutrality,” allowing the company to use a broader range of CPUs and GPUs across its datacenters.

Co-CEO Clay Magouyrk highlighted Oracle’s rapid datacenter expansion, saying the company now has more than 211 live and planned regions and is building 72 multicloud facilities embedded in Amazon, Google, and Microsoft clouds. He said Oracle’s multicloud database business is its “fastest growing business” and rose 817% in the quarter.

Co-CEO Mike Sicilia said Oracle is also embedding AI across its datacenter, database, and applications layers, enabling automation for industries including banking and healthcare.

How Did Stocktwits Users React?

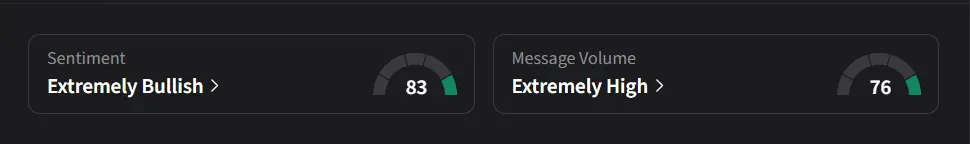

On Stocktwits, retail sentiment for Oracle was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the surge in remaining performance obligations was “absolutely wild,” adding that Oracle’s aggressive capex plan and outsized data-center buildout could deliver outsized rewards if its cloud business “actually earns a seat in the AI economy.”

Another user claimed that the “earnings beat was huge!”

Oracle’s stock has risen 35% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)