Advertisement|Remove ads.

Paras Defence Surges On New Orders; SEBI Analyst Flags Momentum Shift Above 200-Day EMA

Paras Defence has seen a breakout rally, gaining 12% in the past five sessions after receiving fresh defence orders worth ₹26.6 crore from the Defence Ministry. With this addition, its total orders for thermal imaging systems have now reached ₹141.63 crore.

Defense stocks have been in an uptrend, supported by confidence among investors, after the recent spate of orders across the sector, which shows the government is steadily giving more work to homegrown defence companies.

Technical Outlook

SEBI-registered analyst Mayank Singh Chandel noted that from July to August, the stock was weak. But later, the selling slowed down and the stock began moving sideways. This sideways action suggested that buyers were quietly stepping in. The stock also found support near the 200-day Exponential Moving Average (EMA), which worked like a safety net, according to Chandel.

On Monday, Paras Defence finally broke out of this range and crossed a key resistance with heavy volumes, marking a strong shift in momentum.

Chandel concluded that with fresh orders in hand and a breakout on the charts, Paras Defence has turned positive in the short term. Additionally, the 200-day EMA now acts as a strong support level. If the company continues to win new orders, the stock could see more upside from here, he added.

What Is The Retail Mood?

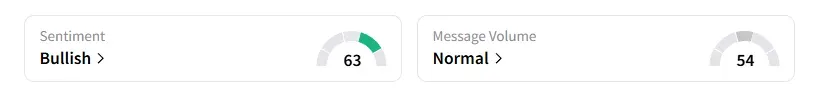

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a month on this multi-bagger defense stock.

Year-to-date, Paras Defence stock has gained 45%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)