Advertisement|Remove ads.

Temu Owner PDD Holdings Stock Dips Ahead Of Earnings, But Retail Keeps Faith

Shares of Shanghai-based online retailer PDD Holdings (PDD), which owns Pinduoduo and Temu, fell over 5% on Friday afternoon.

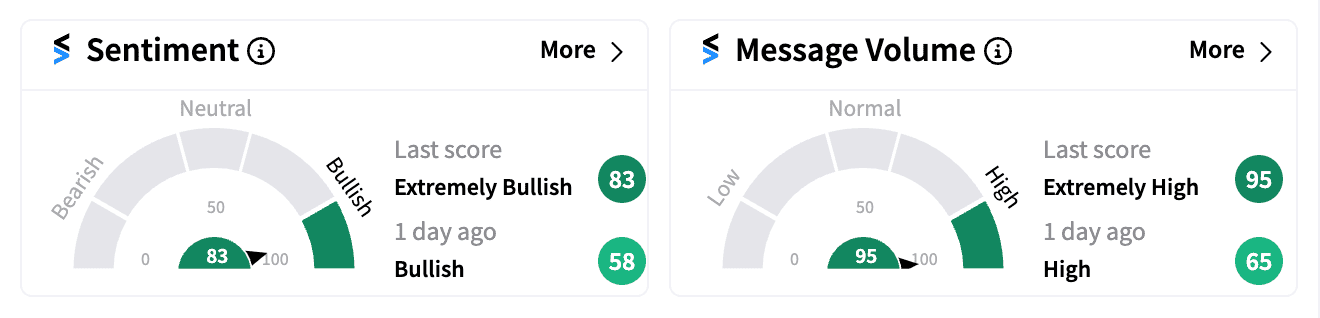

However, retail investors on Stocktwits seem to be using the dip as a buying opportunity, with sentiment reaching ‘extremely bullish’ levels (83/100) and message volume surging.

This optimism comes as PDD prepares to report second-quarter earnings on Monday. Analysts anticipate earnings per share (EPS) of $2.87.

PDD’s earnings come amid Chinese consumers shifting towards budget-friendly platforms like Pinduoduo and Douyin, as the country grapples with an economic slowdown.

Several Stocktwits users expressed confidence in PDD's upcoming earnings report.

One user, referencing JD.com's recent positive earnings, wrote: "Remember JD ER [earnings report] was good a few days back. Can't imagine Monday this won't report great earnings. PDD performance is better than JD in China."

JD.com, a major competitor of PDD, earlier this month reported upbeat second-quarter profits, thanks to effective price cuts that attracted cost-conscious shoppers to its platform.

However, e-commerce giant Alibaba missed analysts' expectations for its quarterly earnings, unnerving some investors.

A user expressed bullishness saying, "Bought the dip. Fear not. MM [Market Makers] in action to collect at cheaper prices."

Another user emphasized PDD's growth potential: "Its growth is incredible. All competitors are losing market share against them. BlackRock recently added a big %. Surely holding it for longer. Imagine that growth when China recovers itself."

Meanwhile, PDD's sister app, Temu, has reportedly gained traction since its September 2022 launch. Offering a wide variety of affordable, often China-made products, it faces increasing competition from established players like Shein and Amazon in the U.S. and other markets.

According to Nikkei, Amazon is actively attracting more Chinese sellers to expand its budget-friendly offerings and compete with Temu and other rivals.

It's worth noting that PDD is down 4% year-to-date, compared with JD.com's 1.2% loss and Alibaba’s 14% gain in the same period.

Additionally, several analysts like Goldman Sachs, Barclays, and Benchmark raised their price targets on PDD following positive Q1 results in May.

It remains to be seen how PDD's earnings report will affect its stock price on Monday. However, the bullish sentiment on Stocktwits suggests that some retail investors are betting on a strong performance.

/filters:format(webp)https://news.stocktwits-cdn.com/gsk_resized_jpg_00efc66e77.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_GE_Aerospace_resized_a883195e2c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_threads_resized_jpg_e588a33209.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/02/pulses-fao.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Albemarle_jpg_770d10f547.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)