Advertisement|Remove ads.

Pennant Group Acquires UnitedHealth’s Certain Divested Operations For Nearly $147M – More Details Inside

The Pennant Group, Inc. (PNTG) on Thursday said that it has acquired certain operations from UnitedHealth Group (UNH) on October 1

The company said that it is purchasing divested home health, hospice, and personal care services in Tennessee, Georgia, and Alabama for a combined purchase price of $146.5 million. These operations were divested as a result of UnitedHealth’s and Amedisys Inc.’s antitrust settlement with the United States Justice Department.

Pennant CEO Brent Guerisoli said that the acquisition is part of the company’s strategic move to enter the Southeast United States. The CEO also noted that Pennant will continue to pursue opportunities for growth in the home health, hospice, and senior living industries.

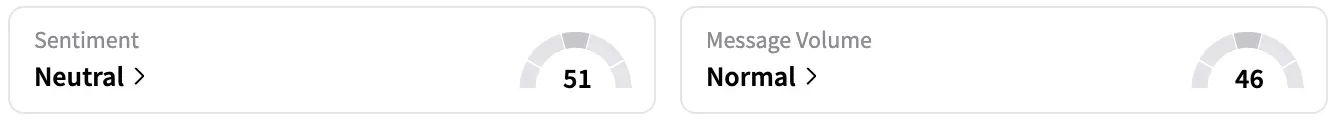

On Stocktwits, retail sentiment around PNTG stock stayed within the ‘neutral’ territory over the past 24 hours, while message volume remained at ‘normal’ levels.

UNH’s Optum unit submitted a proposal to acquire home health and hospice services provider Amedisys in June 2023. UNH had acquired Amedisys’s rival LHC Group earlier that year through a $5.4 billion deal. The U.S. Department of Justice and attorneys general from four U.S. states filed a lawsuit in November 2024 to block the acquisition.

Subsequently, in August, the Justice Department’s Antitrust Division said that it requires broad divestitures, including 164 home health and hospice locations across 19 states, to resolve the challenge to UnitedHealth’s planned acquisition of Amedisys. UNH agreed to the divestitures, and the deal was subsequently closed.

PNTG stock is down by 4% this year and by 22% over the past 12 months.

Read also: DraftKings Shares Rebound 2% In Premarket As Kalshi Challenge Worries Abate

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)