Advertisement|Remove ads.

Persistent Slumps After Q1 Earnings: SEBI RA Sees Sideways Bias Amid Weak Volumes

Shares of Persistent Systems plummeted by over 8% on Thursday, after its quarterly results came in below street estimates, dampening investor sentiment.

The software services company reported a 21.8% rise in revenue from operations to ₹33.88 billion, while profit surged 38% to ₹4.25 billion. EBIT margin slipped 10 bps sequentially to 15.5%, reflecting bottom-line pressure.

The results were driven by growth in BFSI and software & hi-tech segments, but income from its healthcare vertical declined 1.9%. BFSI continued with cloud-native modernizations, while healthcare focused on AI-driven compliance and safety. Meanwhile, tech & software gained from SaaS migration and low-code integration.

Management cautioned about near-term headwinds due to macro and geopolitical uncertainties but remained optimistic about medium-term growth.

Technical outlook

The stock appears to be consolidating within a rising channel after 21 straight quarters of growth, noted SEBI-registered analyst Rajneesh Sharma.

While it trades above key support zones, Persistent Systems’ stock lacks the momentum to break higher decisively. The Relative Strength Index (RSI) at 53.5 indicates mild bullishness, while muted volumes reflect a lack of conviction.

Immediate resistance lies between the ₹5,900 and ₹6,100 zones, with first support at ₹5,200 and a deeper base support around the ₹4,960-₹5,000 range. Until volume confirms a breakout above ₹6,100, the bias remains sideways with a bullish undertone, Sharma added.

At the time of writing, Persistent Systems’ shares were 8.16% lower at ₹5,145.50.

Brokerage Reaction

According to reports, brokerages’ reactions were mixed.

CLSA maintained its ‘Buy’ rating on Persistent but cut the target price to ₹7,536. Nomura reiterated a ‘Neutral’ rating, cutting the target to ₹5,510, citing slower client decision-making and caution over rich valuations at 41x FY27 earnings.

JP Morgan kept an ‘Overweight’ rating with a target price of ₹6,500 as HSBC retained its ‘Hold’ call with an unchanged target price of ₹6,000.

Macquarie reiterated an ‘Outperform’ rating with a target of ₹7,330, while Bernstein maintained its ‘outperform’ view, setting the target at ₹6,300.

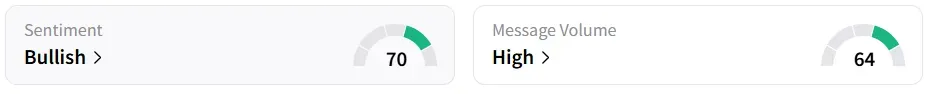

Despite the current stock slump, retail sentiment on Stocktwits remained ‘bullish’ amid ‘high’ message volumes. It was also among the top five most trending stocks on the platform.

Year-to-date (YTD), the stock shed over 20% of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)