Advertisement|Remove ads.

Persistent Systems: SEBI RA Flags Crucial Support Levels Ahead Of Q1 Earnings

Persistent Systems is scheduled to post its quarterly results on Wednesday. Reports suggest that the technology services company is expected to post a net profit of ₹419 crore and margins of 15.6%.

On the technical charts, Persistent Systems is trading just above a critical support zone between ₹5,400 and ₹5,650, which is around 14% lower than its all-time high of ₹6,766, noted SEBI-registered analyst Rohit Mehta.

The stock has entered a consolidation phase after a strong rally and is now attempting to bounce from this level. A decisive move above ₹6,185 resistance could reignite bullish momentum, while any weakness below current support may expose downside toward ₹4,400 - ₹4,550, he added.

Persistent Systems shares had closed 0.8% lower at ₹5,731.50 on Tuesday.

On the fundamentals front, the company has delivered strong earnings lately. For the quarter ended March 2025, sales increased by 25.1%, while operating profit rose by 28.6%. Profit before tax was up 27.9% and EPS increased by 25%. It has a five-year profit CAGR of 32.8%.

The company is nearly debt-free, maintains a healthy 39% dividend payout, and has shown a 10-year median sales growth of 17.6%. However, the stock trades at a premium valuation of 14.1x book value, which could cap short-term upside, Mehta said.

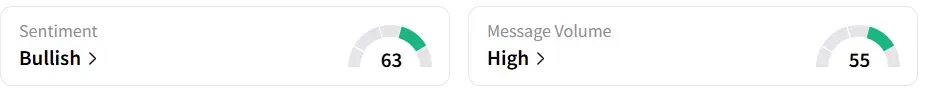

Retail sentiment on Stocktwits remained ‘bullish’ ahead of its Q1FY26 results.

The stock has experienced some selling pressure, shedding 11.5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_hut8_OG_jpg_66d77fe261.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_klarna_OG_jpg_830d4c6bf5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)