Advertisement|Remove ads.

Amid Valuation Concerns, Peter Berezin Says AI Tech Will Likely Become A 'Commoditized Product With Commoditized Margins'

- Berezin said that AI does not benefit from the network effects that social media does, which could have a negative impact on margins in the sector.

- Berezin’s comments are a follow-up to a previous post he made, where he questioned the demand for AI computation if users had to pay $50 to generate a video using the technology.

- He added that costs for AI compute will come down over time, just like broadband became more affordable over time.

Amid ongoing concerns about valuation in the artificial intelligence sector, Peter Berezin, Chief Global Strategist and Director of Research at BCA Research, expressed skepticism about the profitability of AI technology.

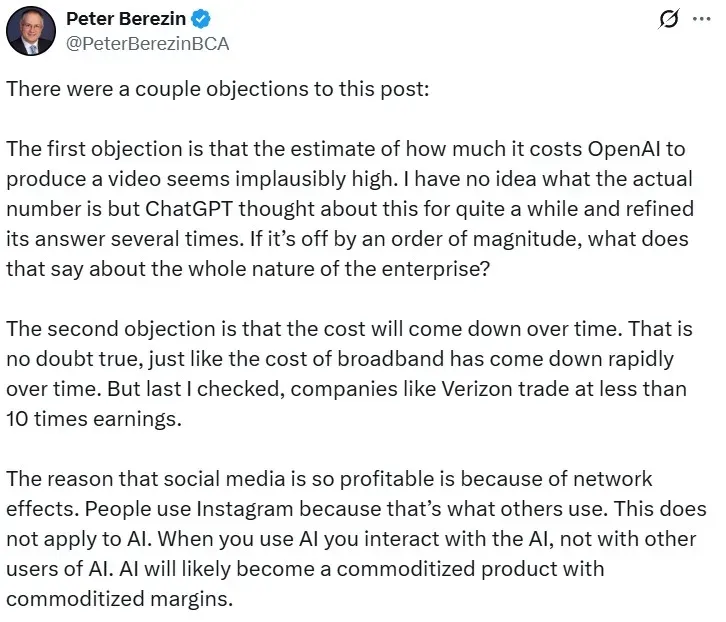

In a post on X, Berezin stated that AI does not benefit from the network effects that social media does, which could have a negative impact on sector margins.

“The reason that social media is so profitable is because of network effects. People use Instagram because that’s what others use. This does not apply to AI. When you use AI you interact with the AI, not with other users of AI,” he said.

Berezin’s comments are a follow-up to a previous post he made, where he questioned the demand for AI computation if users had to pay $50 to generate a video using the technology.

“AI will likely become a commoditized product with commoditized margins,” he said in the post.

AI Compute Demand

With tech giants ramping up their capital expenditure to shore up as much AI infrastructure as they can, Berezin stated that while there is “massive excess demand” for AI compute, the reason for it is that access is free. “Yes, that’s true, just like there would be massive excess demand for cars and homes if cars and homes were free,” he said.

Berezin added that costs for AI compute will come down over time, just like broadband became more affordable over time. However, he said that the stocks of broadband providers like Verizon Communications Inc. (VZ) trade at less than 10 times their earnings (price-to-earnings ratio).

On the other hand, AI infrastructure providers such as Nvidia Corp. (NVDA) and Oracle Corp. (ORCL) trade at 56 and 57 times their earnings, respectively.

Not Everyone Agrees

Earlier on Wednesday, Wedbush Managing Director Dan Ives called out bears on Wall Street for “underestimating” the ongoing boom in U.S. equities driven by AI.

Ives’ optimism comes at a time when AI valuation concerns have gained prominence, following Wall Street CEOs' warnings of a potential pullback in equities.

“Bears have NEVER understood this tech AI driven bull market since early 2023 and all kicked off with Nvidia May 2023 blow out quarter and MSFT/OpenAI,” Ives said in the post, while maintaining his bullish outlook on the technology sector.

Meanwhile, U.S. equities were mixed in Wednesday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down 0.09%, the Invesco QQQ Trust ETF (QQQ) declined 0.23%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose 0.08%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘extremely bearish’ territory.

The iShares U.S. Technology ETF (IYW) was down 0.21% at the time of writing.

Also See: Nebius Unveils Platform To Run Open Models, Taking On Microsoft After $19B Deal In September

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)