Advertisement|Remove ads.

Dan Ives Says Wall Street Is ‘Underestimating’ Scale And Scope Of AI Revolution: ‘Bears Have Never Understood This…’

- Ives expressed optimism despite concerns about AI valuation, which have gained prominence after Wall Street CEOs warned of the possibility of a pullback in equities.

- He maintained his bullish outlook on the technology sector, saying he buys tech stocks on sell-offs.

- The Future Fund’s Managing Partner, Gary Black, joined Ives to dismiss valuation concerns.

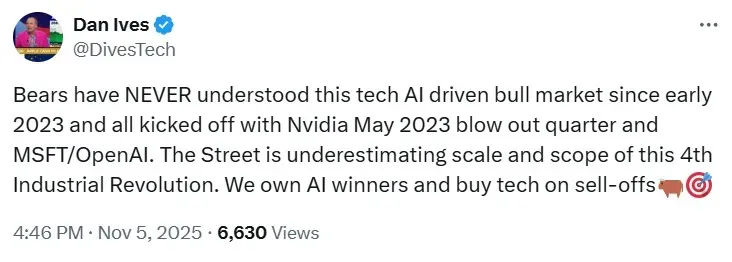

Wedbush Managing Director Dan Ives on Wednesday called out bears on Wall Street for “underestimating” the ongoing boom in U.S. equities driven by artificial intelligence.

In a post on X, Ives expressed optimism despite concerns about AI valuation, which have gained prominence after Wall Street CEOs warned of the possibility of a pullback in equities.

“Bears have NEVER understood this tech AI driven bull market since early 2023 and all kicked off with Nvidia May 2023 blow out quarter and MSFT/OpenAI,” Ives said in the post.

He maintained his bullish outlook on the technology sector, saying, “We own AI winners and buy tech on sell-offs.”

Goldman Sachs CEO David Solomon warned about a potential drawdown at an investment summit in Hong Kong on Tuesday, according to a report by CNBC. “It’s likely there’ll be a 10 to 20% drawdown in equity markets sometime in the next 12 to 24 months,” he said. At the same event, Morgan Stanley CEO Ted Pick also warned of the possibility of a 10% to 15% pullback, according to the report.

Ives Not Alone

The Future Fund’s Managing Partner, Gary Black, on Wednesday joined Ives to dismiss valuation concerns.

“We don’t share others’ concerns about valuations - S&P 500 earnings yield of 4.4% (inverse of 22.6x forward P/E) still offers +30bp premium vs 10yrTY,” Black said in a post on X, referring to 10-year Treasury Yield, which is currently hovering at 4.09%.

He added that the government shutdown will be over before Thanksgiving. The U.S. government has now been shut down for 36 days.

Valuation Concerns Drag Nasdaq Down

AI valuation concerns dragged U.S. equities down on Tuesday, with the tech-heavy Nasdaq Composite logging a 2% decline.

‘The Big Short’ legend Michael Burry placed short bets against Palantir Technologies Inc. (PLTR) and Nvidia Corp. (NVDA). His hedge fund, Scion Asset Management, disclosed put options worth $912 million against Palantir and $187 million against Nvidia, as of Sept. 30, 2025, in a 13F filing with the U.S. Securities and Exchange Commission (SEC).

This drew a sharp reaction from Palantir co-founder and CEO, Alex Karp, who said that by shorting Palantir and Nvidia, Burry is actually shorting AI. “I do think this behavior is egregious and I’m going to be dancing around when it’s proven wrong,” Karp said, in reference to the practice of short selling.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)