Advertisement|Remove ads.

Children’s Place Stock Skyrockets Over 60% On Surprise Profit, Retail Turns ‘Extremely Bullish’

Shares of The Children’s Place, Inc. (PLCE) surged more than 60% on Wednesday after the retailer posted a surprise second-quarter profit, defying analyst expectations of a significant loss and sending retail investors into a frenzy.

Children’s Place reported adjusted earnings of $0.30 per share for the quarter ended Aug. 3, versus the consensus estimate of a $1.05 per share loss. Revenue came in at $319.7 million, slightly below the $320.14 million forecast and down 7.5% from the same period last year.

Interim CEO Muhammad Umair attributed the unexpected profit to strategic and operational changes aimed at improving profitability and setting the foundation for future growth.

“We proactively made certain strategic and operational changes to improve the profitability of the business, and we were pleased with the results,” he said.

Cost-cutting measures were a significant factor, with adjusted selling, general, and administrative expenses slashed by over 13% to a 15-year low of $88.3 million.

Comparable retail sales dropped 7.2%, driven mainly by a planned decrease in e-commerce as the company cut unprofitable online sales. However, physical stores saw their first positive comparable store sales since 2021, boosted by stronger units per transaction, improved conversion rates, and better traffic trends.

The company closed three stores during the quarter, ending with 515 stores.

As of Aug. 3, Children’s Place had $9.6 million in cash and cash equivalents, with $316.7 million outstanding on its revolving credit facility and no long-term debt.

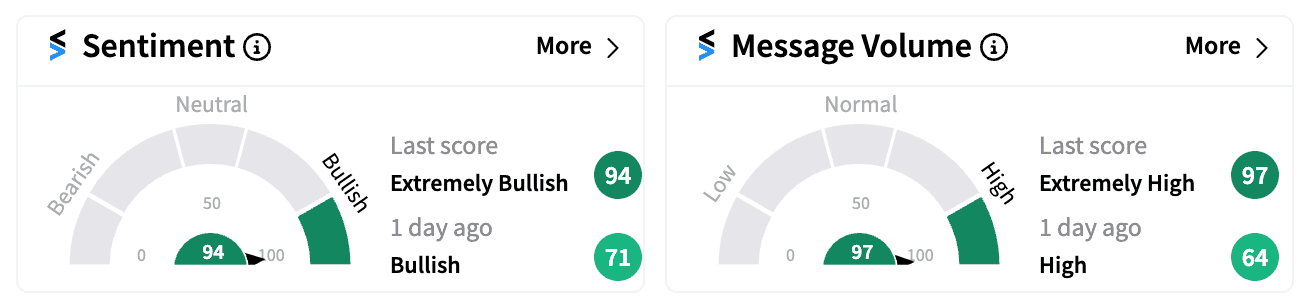

Retail sentiment on Stocktwits soared, with the sentiment score flipping to ‘extremely bullish’ (94/100), the highest level this year accompanied by a surge in message volume.

Children’s Place has seen its stock fall over 64% this year due to broader weaknesses in the retail sector amid high inflation and shifting consumer behaviors.

The stock’s rebound also comes after a leadership shake-up in May, when longtime CEO Jane Elfers left the company under a “mutual agreement,” and Umair, with a finance background, stepped in as interim CEO.

The company has also seen a significant shift in its ownership structure, with Saudi-based Mithaq Capital acquiring 54% of its outstanding shares in February, a move that was labeled a “change of control” by the company.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)