Advertisement|Remove ads.

Piedmont Lithium Stock Surges As Ghana Greenlights Ewoyaa Mining Permit: Retail ‘Extremely Bullish’

Shares of Piedmont Lithium ($PLL) jumped nearly 15% on Wednesday morning, capturing the interest of retail investors.

The company announced that the Minerals Commission of Ghana has issued a Mine Operating Permit for the joint venture Ewoyaa Lithium Project, developed in partnership with Atlantic Lithium Limited.

"We look forward to the future development of the Ewoyaa project in due course, subject to the outcome of the mining lease ratification by the Ghanaian Parliament, other ongoing design works, and prevailing market conditions," said Patrick Brindle, CEO of Piedmont Lithium.

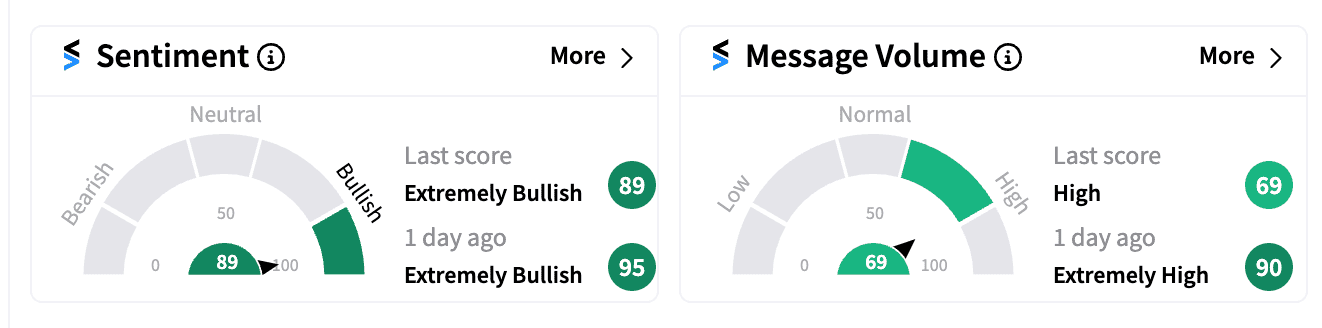

Piedmont Lithium was among the top ten trending tickers on Stocktwits Wednesday morning, with retail sentiment staying in ‘extremely bullish’ (87/100) territory.

Over a week ago, the company received an environmental permit for the Ewoyaa project.

In August 2023, Piedmont announced it had exercised its option to acquire a 22.5% interest in Ewoyaa, subject to government approvals, as part of a staged investment agreement to eventually secure a 50% equity interest in Atlantic Lithium’s Ghanaian lithium portfolio.

In September this year, Piedmont withdrew its application for a debt package from the U.S. Department of Energy’s Loan Programs Office, indicating it would scale back ambitious expansion plans across two continents.

That move came as lithium prices weakened amid Chinese overproduction and sluggish EV demand.

The company reported $59 million in cash at the end of June, with a long-term debt of $2 million. It laid off nearly a third of its workforce earlier this year.

As of last close, PLL’s stock is down nearly 55% this year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)