Advertisement|Remove ads.

Palantir, Gevo, GE Vernova Stocks Hit Fresh 52-Week Highs: Retail Bullish Only On Two

Shares of AI-focused data analytics firm Palantir Technologies (PLTR), biofuels company Gevo (GEVO), and energy equipment maker GE Vernova (GEV) hit fresh 52-week highs on Tuesday. However, retail investors are notably bullish on only two of these stocks.

Palantir’s Momentum Continues

Palantir — a new entrant on the S&P 500 — has had a stellar 2024 run, with year-to-date gains exceeding 117%.

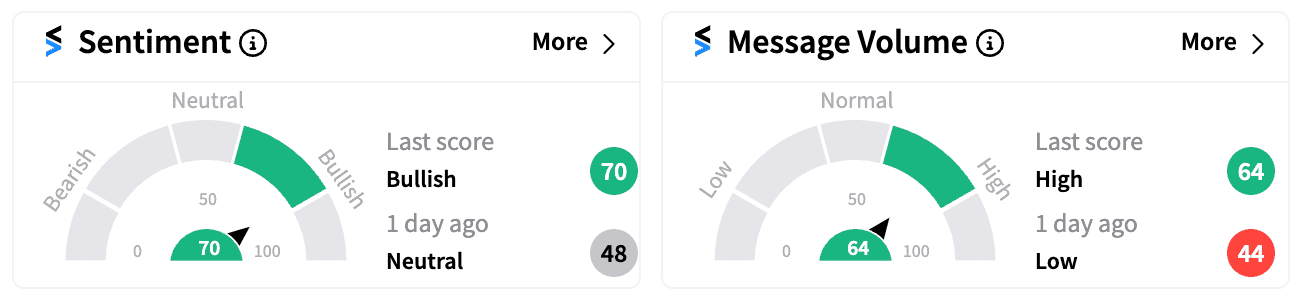

Despite some selling pressure on Tuesday, retail sentiment remains strong with a ‘bullish’ score (70/100) on Stocktwits, driven by two new catalysts.

First, Bank of America added Palantir to its prestigious US 1 List, a selection of the firm's top investment ideas. Second, Palantir announced an expanded contract with Nebraska Medicine, a $2.5 billion academic health system.

The partnership, centered around Palantir’s AI Platform (AIP), aims to optimize healthcare operations. Since teaming up with Palantir, Nebraska Medicine reported a staggering 2000% increase in Discharge Lounge utilization.

Gevo’s Biofuel Surge

Gevo surged over 14% after securing a patent for its ethanol-to-olefins (ETO) process, a breakthrough expected to cut both energy and capital costs.

The patent is already licensed to LG Chem, marking a strategic win.

Gevo also recently landed a $16.8 million FAA grant to convert a Minnesota fuel facility into an alcohol-to-jet production site, aligning with the Biden administration’s net-zero aviation emissions goal by 2050.

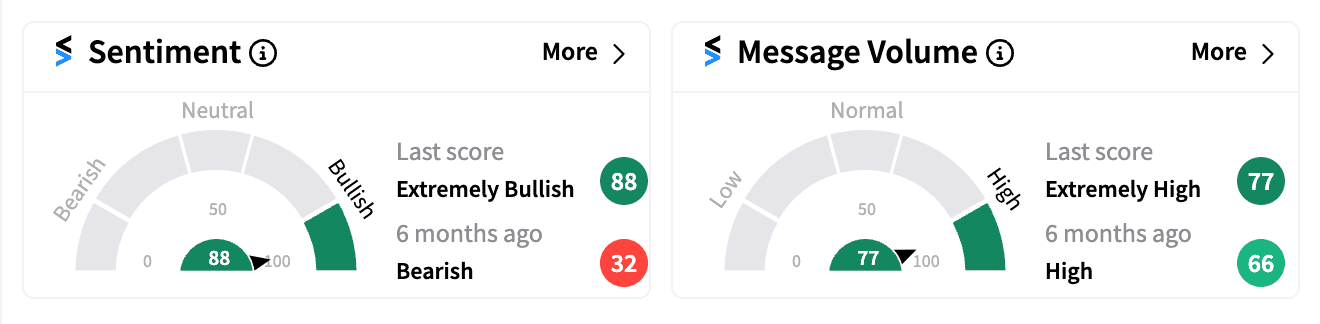

Retail investors are taking notice. On Stocktwits, Gevo’s bullish sentiment (88/100) reached a 2024 peak as optimism around its clean energy advancements grew. This year, the stock has risen more than 42%.

GE Vernova Faces Mixed Sentiment

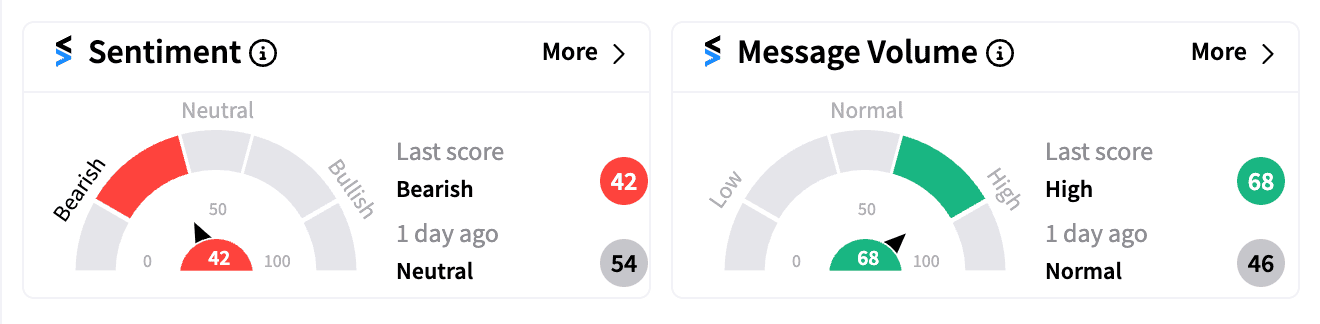

Despite rising nearly 4% on Tuesday, GE Vernova’s retail sentiment lags with a ‘bearish’ (42/100) outlook.

BofA and RBC Capital raised their price targets for GE Vernova on Tuesday, citing robust demand for electrification infrastructure and optimism around its gas power services.

While retail sentiment remains cautious, analysts see long-term growth potential, with revenue expected to grow faster than the company's mid-single-digit target.

In 2024 so far, GE Vernova is up more than 80%; but some retail investors appear wary after the company recently trimmed its Q3 profitability outlook.

Read next: Carvana Stock Jumps, Drawing Retail Buzz Amid Analyst Optimism

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Northrop_Grumman_resized_7270231cb2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_spglobal_OG_jpg_61bf3a69e9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_constellation_energy_three_mile_island_resized_3185b1517a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)