Advertisement. Remove ads.

PNB sees big uptick in vehicle, housing loans; Shriram Finance stays cautious

Ashok Chandra, MD & CEO of Punjab National Bank highlighted that lower cement taxes would boost housing loan demand, while Umesh Revankar, Executive Vice Chairman of Shriram Finance cautioned that growth momentum may face headwinds from factors like US tariffs on some MSME segments.

Share this article

The recent goods and services tax (GST) rate reductions could provide a 1% to 2% boost to credit growth across key sectors, according to Ashok Chandra, Managing Director and CEO of Punjab National Bank (PNB).

Describing the tax changes as a "landmark day," Chandra outlined a positive outlook for the agriculture, retail, and Micro, Small, and Medium Enterprises (MSME) segments.

Chandra highlighted that vehicle loans are expected to see significant traction, forecasting growth of around 24 to 25% in long run.

He attributed this to the GST rate on vehicles being reduced from 28% to 18%, along with lower taxes on spare parts and tyres. "Going to be a big activity happening in the vehicle loan segment," he stated.

For the MSME sector, where PNB's credit is already growing at over 18% year-on-year, Chandra anticipates the GST changes will add a minimum of 1 to 2% to this growth in the long run. He also pointed to benefits in the housing loan segment, noting that lower tax on cement would reduce construction costs and subsequently boost demand.

In the agriculture sector, where PNB has an exposure of over ₹1.3 lakh crore, Chandra expects rate cuts on equipment and spare parts to build "good momentum" and provide relief to the rural economy.

Speaking on the outlook for the non-banking financial company (NBFC), Umesh Revankar, Executive Vice Chairman of Shriram Finance confirmed that loan growth is expected to be higher this quarter, in the range of 17 to 18%, driven by festive demand.

However, he expressed caution, "whether it will keep the momentum for a long time, we are not very sure," he said, citing uncertainties such as the impact of US tariffs on some MSME segments.

He suggested that the real trend will become clearer in the next quarter, once the festive season's domestic demand has passed.

Shriram Finance maintains its annual growth guidance of around 15%, underscoring confidence in domestic demand and potential government support measures for MSMEs, including interest subsidies or power tariff reductions.

Watch accompanying video for more

Catch all the stock market live updates here

Read about our editorial guidelines and ethics policyDescribing the tax changes as a "landmark day," Chandra outlined a positive outlook for the agriculture, retail, and Micro, Small, and Medium Enterprises (MSME) segments.

Chandra highlighted that vehicle loans are expected to see significant traction, forecasting growth of around 24 to 25% in long run.

He attributed this to the GST rate on vehicles being reduced from 28% to 18%, along with lower taxes on spare parts and tyres. "Going to be a big activity happening in the vehicle loan segment," he stated.

For the MSME sector, where PNB's credit is already growing at over 18% year-on-year, Chandra anticipates the GST changes will add a minimum of 1 to 2% to this growth in the long run. He also pointed to benefits in the housing loan segment, noting that lower tax on cement would reduce construction costs and subsequently boost demand.

In the agriculture sector, where PNB has an exposure of over ₹1.3 lakh crore, Chandra expects rate cuts on equipment and spare parts to build "good momentum" and provide relief to the rural economy.

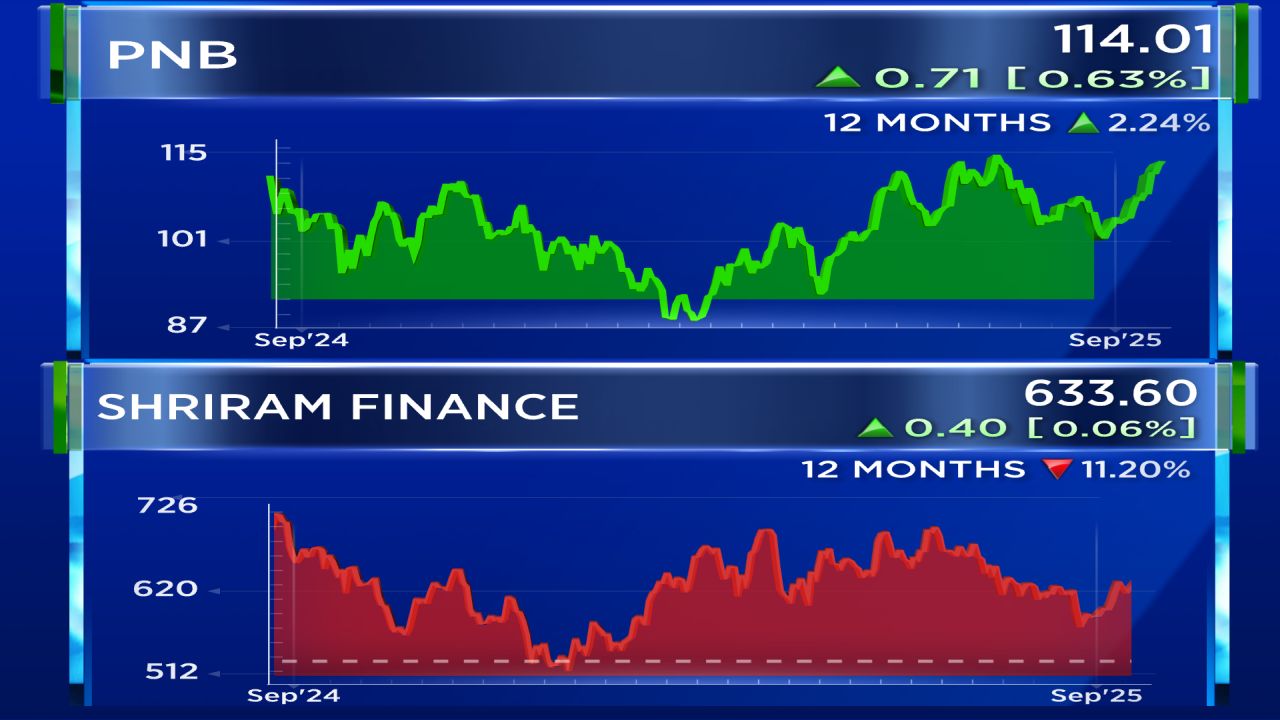

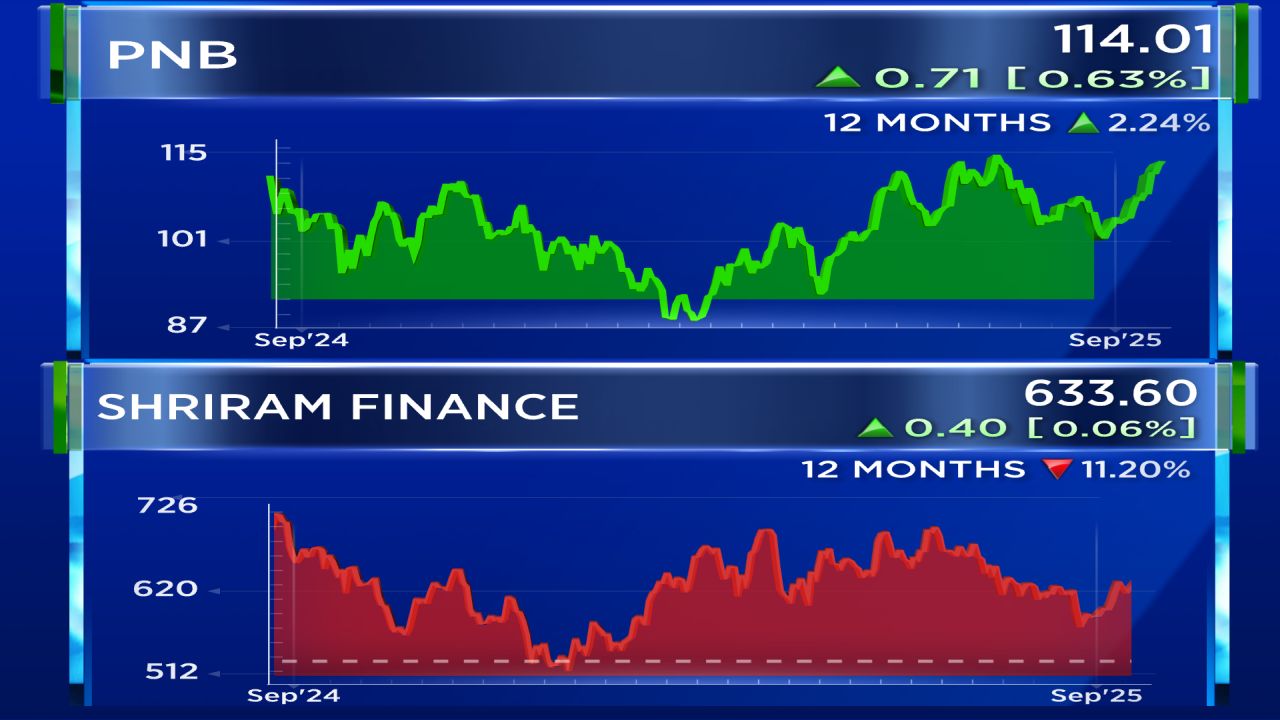

PNB’s shares and Shriram Finance’s shares are currently trading at ₹113.97 and ₹632.60 respectively as of 11:31 am on the NSE.

Speaking on the outlook for the non-banking financial company (NBFC), Umesh Revankar, Executive Vice Chairman of Shriram Finance confirmed that loan growth is expected to be higher this quarter, in the range of 17 to 18%, driven by festive demand.

However, he expressed caution, "whether it will keep the momentum for a long time, we are not very sure," he said, citing uncertainties such as the impact of US tariffs on some MSME segments.

He suggested that the real trend will become clearer in the next quarter, once the festive season's domestic demand has passed.

Shriram Finance maintains its annual growth guidance of around 15%, underscoring confidence in domestic demand and potential government support measures for MSMEs, including interest subsidies or power tariff reductions.

Watch accompanying video for more

Catch all the stock market live updates here

Subscribe to The Daily Rip India

All Newsletters

The most relevant Indian markets intel delivered to you everyday.

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tapestry_Coach_resized_jpg_e11691b7b6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Coal_stock_jpg_9cd071cbfb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_1f3537ce02.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/12/metro-brands-2024-12-8e6b9d7183137926202c6389f4237017.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tradingfloor_jpg_dce65df922.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)