Advertisement|Remove ads.

Polycab Shares Gain After Strong Q4: SEBI RAs See Uptrend Continuing Till ₹6,400

Polycab India shares gained 2% amid broader market weakness on Tuesday after the electrical equipment company delivered a strong performance in the fourth quarter, with its net profit rising 33% year-on-year to ₹727 crore.

Revenue from operations grew 25% to ₹6,985 crore, driven by strong growth across all business segments.

The wires and cables division — Polycab’s core segment — posted a 22% year-on-year revenue increase.

Meanwhile, the fast-moving electrical goods (FMEG) business grew by 33%, and the EPC segment led with a sharp 47% jump.

Operating margins also saw healthy expansion, with EBITDA rising nearly 35% to ₹1,025.7 crore and margin improving 110 basis points to 14.7%.

The board has recommended a final dividend of ₹35 per equity share for FY25, subject to shareholder approval.

SEBI-registered analyst Prabhat Mittal notes that following its quarterly results, Polycab India broke through all significant resistance levels and reached a high of ₹6,077.

Mittal points out that Polycab formed a double bottom at ₹4,560 and has since been making higher highs, indicating a positive short-term trend.

The stock is currently trading above both its 20-day and 50-day moving averages, and the MACD (12,26) is providing a buy signal, further supporting the bullish outlook.

Given these technical factors, Mittal suggests that traders consider buying Polycab near the ₹5,750–₹5,700 range, with a strict stop loss at ₹5,500 and a target of ₹6,200–₹6,400.

Meanwhile, Financial Independence advises keeping Polycab on the radar if it holds above ₹6,035.

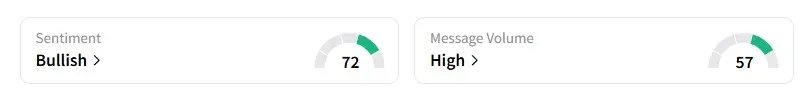

Data on Stocktwits shows that retail sentiment on Polycab remains ‘bullish.’

Polycab shares have fallen 19% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)