Advertisement|Remove ads.

Purple Biotech's Shrinking Losses Keep Retail Sentiment In The Green, But Other Pressures Loom

Shares of Purple Biotech closed down 3.4% on Monday and extended losses in after-hours trading as the company's latest financial results failed to impress the broader market, though retail traders showed some optimism.

The company reported a net loss of $0.4 million for the fourth quarter of 2024, significantly narrowing from the $4.9 million loss in the same period a year earlier, primarily due to lower research and development (R&D) expenses.

Loss per American depository share (ADS) was $0.20 (basic) and $0.26 (diluted), compared to $3.80 per ADS in Q4 2023, and better than LSEG's mean analyst estimate of a loss of $1.80.

CEO Gil Efron highlighted key 2024 milestones, including successful trials for its clinical-stage programs for its cancer therapy candidates CM24 and NT219 and advancements in its CAPTN-3 tri-specific platform.

The randomized Phase 2 trial for CM24 in second-line pancreatic cancer met all efficacy endpoints, and biomarker data informed a planned Phase 2b study for the second half of 2025.

Meanwhile, NT219's dose escalation study determined a recommended Phase 2 dose, enabling a head and neck cancer trial in collaboration with the University of Colorado, expected to begin enrollment in early 2025.

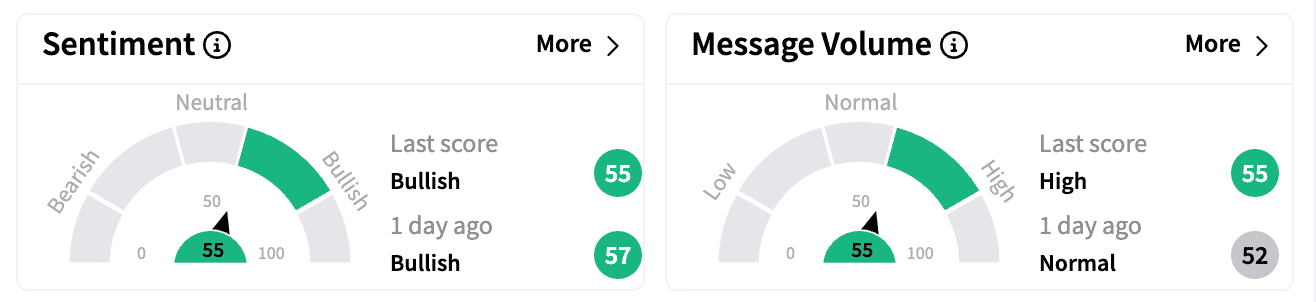

Retail sentiment on Stocktwits ended on a bullish note on Monday, but the score was slightly lower than a day ago.

Some traders pointed to Purple Biotech's cash runway as a positive factor and speculated that institutional investors may disclose their positions in upcoming 13-F filings, given the strong stock-buying volume observed this year.

However, skepticism also lingered. One user questioned the absence of a clear regulatory path for the company's drug candidates, arguing that cost-cutting measures were meaningless without a concrete FDA approval strategy.

Others accused management of raising capital to "milk it for salaries."

As of Dec. 31, 2024, Purple Biotech had $8.2 million in cash and short-term deposits, which it expects will be sufficient to fund operations into mid-2026.

In Q4, the company raised $2.8 million through a registered direct offering and an additional $1.5 million via an open-market sale of 298,000 ADSs at an average price of $3.50.

Purple Biotech's stock has lost over 45% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_CEO_OG_jpg_7352181faa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)