Advertisement|Remove ads.

Qualigen Therapeutics Stock Soars 62% After-Hours On BitGo Crypto Deal — Traders Warn Of ‘Bear Day’ Ahead

- Qualigen announced a $30 million partnership with BitGo to manage its C10 digital asset treasury, marking a deeper push into crypto and Web3 under Faraday Future’s ownership.

- The company plans to diversify holdings across the top 10 cryptocurrencies through BitGo’s custody and OTC trading platform.

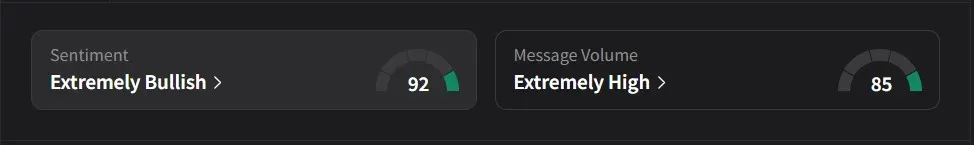

- Retail sentiment on Stocktwits was ‘extremely bullish’ after the news, though some traders warned of profit-taking and a possible Friday pullback.

Shares of Qualigen Therapeutics Inc. surged 62% in after-hours trading on Thursday after the company announced a partnership with BitGo to manage its C10 digital asset treasury, marking a major step in its shift toward crypto and Web3.

The deal will see Qualigen allocate $30 million to a market-cap-weighted basket of the world’s top 10 cryptocurrencies (excluding stablecoins), using BitGo’s custody, liquidity, and OTC trading platform. The partnership is designed to bolster the company’s balance sheet diversification strategy while maintaining security through regulated cold storage and compliance-grade infrastructure.

BitGo CEO Mike Belshe called the partnership “a $30 million multi-asset allocation that demonstrates the growing confidence among enterprises in building a digital-first treasury strategy.”

The Crypto Pivot

The move follows Faraday Future Intelligent Electric’s announcement last month that it would invest $41 million in Qualigen, giving the California-based EV maker a majority stake. Faraday contributed $30 million for roughly 55% ownership, while its founder YT Jia added $4 million through an FF Global Partners loan, securing about 7% more.

The investment is part of Faraday’s broader plan to rebrand Qualigen as CXC10, shifting focus from biotech to crypto and Web3 under a three-pronged strategy, including the C10 value anchor, BesTrade DeAI Agent, and ecosystem tokens such as a planned stablecoin.

Jia said the initiative aims to connect AI and crypto, bridging Web2 and Web3 technologies to create value for both shareholders and token holders.

Faraday previously revealed that the C10 Treasury had already deployed $10 million in crypto assets, generating an unrealized 7% gain by mid-September, outperforming the C10 Index benchmark.

Stocktwits Traders Eye Profit-Taking

On Stocktwits, retail sentiment was ‘extremely bullish’ amid a 7,700% surge in 24-hour message volume.

One user said they had bought shares of Qualigen but didn’t expect the rally to last, adding that crypto treasuries seemed to be losing steam and they planned to sell if the stock reached $6.

Another user cautioned traders to “take profit now,” noting that Friday could turn into a “bear day” for Qualigen.

Qualigen’s stock has declined 16% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)