Advertisement|Remove ads.

Ralph Lauren Signals Tariff Pressures Aren’t Hitting Its Customers — Retail Investors Cheer Strong Q4

Ralph Lauren Corp (RL) on Thursday said consumers continued to spend on its luxury fashion goods despite economic and policy uncertainties, and it would raise prices to offset the impact of tariffs.

The comments build confidence that a slump in retail spending might not be as severe as earlier expected or is limited to certain pockets of the market. Ralph Lauren shares rose 1.3%.

The company guided for single-digit growth in the top line, on a constant currency basis, in fiscal 2026, compared to an 8% growth in FY2025.

The outlook follows reports that France's LVMH, the world's largest fashion conglomerate, is tempering expectations for the current quarter amid notable softness in the Chinese market.

"While tariffs are expected to be a headwind, we are better positioned than ever before with greater agility to mitigate related pressures with a more elevated, less price-sensitive customer base," CFO Justin Picicci said on the analyst call.

Management said it would raise prices more than planned this year, and diversify its supply chain to counter tariff headwinds.

For the fiscal Q4, Ralph Lauren's adjusted profit rose to $2.27 per share, and revenue rose to nearly $1.7 billion.

The figures surpassed Wall Street's expectations of $2.04 per share EPS and $1.65 billion in revenue, according to FactSet.

Comparable store sales increased 9% in North America, 18% in Europe, and 15% in Asia.

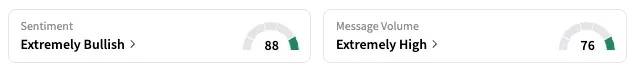

On Stocktwits, the retail sentiment was 'extremely bullish,' unchanged from a week ago.

Posting through its Stocktwits account, Zacks Research said, "$RL's fiscal Q4 results reflect strong brand momentum and financial discipline, setting the stage for continued growth in fiscal 2026."

For the ongoing quarter, Ralph Lauren expects revenue to grow by high single digits on a constant-currency basis and might be "marginally" impacted by tariffs.

Ralph Lauren shares are up 20.1% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)