Advertisement|Remove ads.

RBL Bank–Emirates NBD $3 Billion Deal: Analyst Sees Long-Term Growth Despite Mixed Q2

- RBL Bank shares soared to a fresh 52-week high.

- Analyst views Emirates deal as a turning point that strengthens the balance sheet.

- Strong cost control, asset quality improvement, and a mega investment from Emirates have turned retail sentiment bullish.

RBL Bank shares surged 7% on Monday, hitting a fresh 52-week high after the bank reported earnings for the second quarter of the financial year (Q2FY26) and secured a massive deal with Emirates NBD, providing a capital infusion of $3 billion.

Emirates NBD Bank will acquire a 60% stake in RBL Bank for approximately $3 billion (₹26,853 crore) through a preferential equity issuance of 96 crore new shares at ₹280 each, approved by the RBL Bank board. This deal marks the largest foreign direct investment (FDI) in the Indian banking sector.

SEBI-registered analyst Front Wave Research noted that while standalone profitability saw year-on-year (YoY) declines, there were positive sequential inflections in net interest income (NII), and asset quality, alongside strong cost control. They added that the partnership with Emirates is a game-changer, positioning the bank for long-term stability and growth despite mixed quarterly operational results.

RBL Bank Q2 Fineprint

Pre-provision operating profit (PPOP) growth was supported by a moderation in operating expenses. Operating Expenses fell by 5% quarter-on-quarter (QoQ), demonstrating strong cost control and aligning with management's guidance.

However, higher provisioning during the quarter weighed on profitability, resulting in a 20% year-on-year decline in profit after tax (PAT). Net Interest Income (NII) showed a sequential increase of 4.7% quarter-on-quarter (QoQ), suggesting stabilization in margins as guided.

Gross NPA % improved commendably to 2.32% from 2.78% in Q1 FY26 and 2.88% in Q2 FY25, Front Wave highlighted.

Retail Banking segment's pre-tax loss significantly improved sequentially to (₹21.47 crore) from (₹166.52 crore) in Q1 FY26. The corporate/wholesale banking segment showed a strong rebound with PBT increasing 65.0% QoQ to ₹192.60 crore.

According to the analyst, the massive capital infusion of up to ₹26,853.28 crore by Emirates NBD fundamentally strengthens the balance sheet and addresses long-term capital concerns.

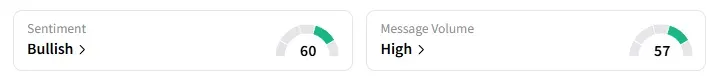

What is the retail mood on Stocktwits?

Data on Stocktwits showed that retail sentiment turned ‘bullish’ amid ‘high’ message volumes.

RBL Bank stock remains under a ban in the futures and options (F&O) segment today.

RBL Bank has had a strong run in 2025, with its shares surging 104% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)