Advertisement|Remove ads.

Reliance Shares Gain Ground: SEBI RA Aditya Hujband Advises Caution Near ₹1500

Reliance Industries shares extended their rally on Friday, continuing a strong upward trajectory that has seen the heavyweight stock consistently outperform the Nifty and lead the broader market higher in recent weeks.

The stock climbed closer to the ₹1500 mark — an area that has historically acted as a strong resistance zone.

According to SEBI-registered analyst Aditya Hujband (MBA Investmentwala), Reliance has shown robust bullish momentum, with a sharp rise from the ₹1150–₹1200 levels. It is now fast approaching the ₹1460–₹1500 zone, which has previously acted as a key supply region.

He notes that the stock is currently trading above all major moving averages, underlining strong bullish sentiment in both short- and medium-term timeframes.

Aditya points out that the expanding Bollinger Bands reflect increasing volatility and signal price expansion, a pattern typically associated with strong market interest.

However, the Relative Strength Index (RSI) has crossed 78, placing it in overbought territory — a signal that suggests the rally might be overstretched in the short term.

As Reliance nears the ₹1500 resistance, Aditya believes momentum could taper off, leading to either sideways consolidation or a brief pullback.

He believes that a breakout above this zone, especially if accompanied by high volumes, could pave the way for a move toward ₹1600.

On the flip side, a pullback could see support around ₹1365–₹1350, with a deeper floor at ₹1300.

From a trading standpoint, he advises a cautious approach for fresh long positions, recommending that existing holders consider trailing stop-losses or partial profit booking as the stock tests its upper resistance band.

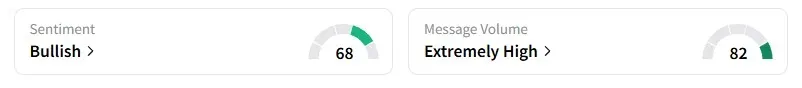

Data on Stocktwits shows that retail sentiment was ‘bullish’ for RIL on Friday afternoon.

RIL shares gained 17% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)