Advertisement|Remove ads.

Retail Bulls Rally Behind Trump Jr.-Backed GrabAGun Even As Stock Halves After NYSE Debut

GrabAGun Digital Holdings (PEW), the firm backed by Donald Trump Jr., which started trading on the New York Stock Exchange after its SPAC merger with Colombier Acquisition Corp. II on Wednesday, has been on the fence with investors since its debut and has lost more than half of its value.

The company’s shares, which opened at $21.40, traded at $10.11 at noon on Friday. GrabAGun had seen an 11% surge when the markets opened, but it immediately lost all gains and was marginally down at the time of writing.

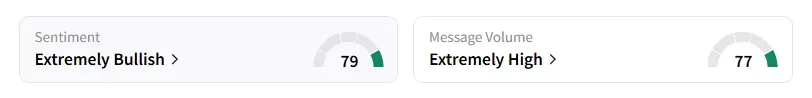

Retail sentiment on GrabAGun was ‘extremely bullish’ with chatter at ‘extremely high’ levels, according to data from Stocktwits.

GrabAGun was one of the top 10 most active stocks on Stocktwits by symbol page views and message volume since July 15, a day before the NYSE debut. The platform added over 2,500 Stocktwits watchers for the stock over this period.

“$PEW you can’t trust any rally in this stock. It just takes one trade to bring it down and you don’t know when it is coming,” said a Stocktwits user.

Another user noted that Trump Media & Technology Group Corp (DJT) had also started similarly before trading higher.

President Trump’s son is a part of the company and helped ring the opening bell at the NYSE. He owns about 300,000 shares.

GrabAGun was founded in 2010 and offers a range of products, including sporting firearms, ammunition, and accessories.

The company reported a negative cash flow of $2.85 million for the full year 2024, according to an SEC filing in March.

Its total revenue for the year came in at $93.12 million, compared to $96.28 million in the previous year. The firm posted a net income of $4.3 million in 2024, nearly flat year-over-year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: 3M Retail Investors Cheer Guidance After Company Reduces Trump Tariff Impact Forecast

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)