Advertisement|Remove ads.

3M Retail Investors Cheer Guidance After Company Reduces Trump Tariff Impact Forecast

3M (3M) on Friday reduced its estimated net impact from U.S. President Donald Trump’s tariff policies on full-year 2025 profit to $0.10, helping it raise its earnings per share forecast for the year following the United States and China reaching a trade deal.

The company had said in April that it expected a net impact of between $0.20 and $0.40 on its earnings.

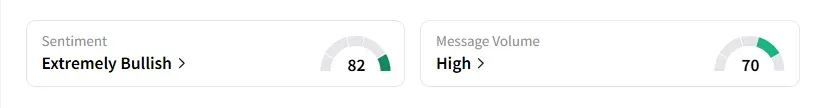

3M’s shares were down 2% in early trading. Retail sentiment on the stock has been in the ‘extremely bullish’ territory with message volumes at ‘high’ levels, according to Stocktwits data.

Retail user messages on 3M increased by 475% on Stocktwits over the last 24 hours, with a bullish user on the platform saying the guidance was “good” and that there were not many supply chain issues or tariff issues.

Major U.S. companies have now begun to provide updated guidance on the impact of tariffs, as many of their global trading partners, including the U.K., Vietnam, and Indonesia, have been negotiating with Trump.

Johnson & Johnson (JNJ) also revised its forecast of the impact of tariffs on Wednesday to $200 million, down from the firm’s estimate of $400 million made in April.

3M’s second-quarter sales came in at $6.16 billion, compared with Wall Street’s expectations of $6.07 billion, according to data compiled by Fiscal AI.

Its quarterly adjusted profit per share was $2.16, compared with analysts' estimates of $2.01.

3M also reduced its estimated impact on gross earnings per share to approximately $0.20, down from an earlier expectation of roughly $0.60.

The company forecast its full-year adjusted profit per share to be between $7.75 and $8.00, up from prior estimate of $7.60 to $7.90.

The company’s stock has risen over 20% year-to-date and surged nearly 50% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: SLB CEO Highlights Customer Caution In Offshore Deepwater Market: But Retail Bulls Hold Steady

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)