Advertisement|Remove ads.

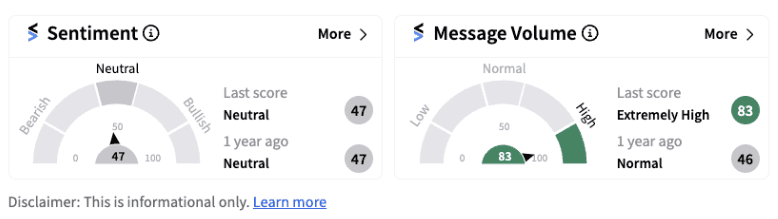

Retail Investors Remain Neutral On Beyond Meat Stock Despite Restructuring Report And 13% Fall In Stock

Retail sentiment for the plant-based meat substitute producer Beyond Meat Inc. dipped from the extremely bullish territory on Wednesday to neutral (47/100) after a Wall Street Journal report stated that bondholders of the firm are engaged in discussions with the firm about a restructuring of its balance sheet.

Shares of the firm dipped about 14% in Thursday’s pre-market trading. According to the report, the group of bondholders are working with the company’s law firm for a possible restructuring. With declining revenues and the company reporting net loss after net loss, its cash balance is dwindling.

Let’s understand these metrics from the company’s earnings. For the quarter ended March 2024, the firm reported an 18% decline in its net revenue at $75.60 million. Loss from operations stood at $53.47 million compared to loss from operations of $57.72 million in the year-ago period. The company’s cash and cash equivalents balance, including restricted cash, stood at $173.50 million and total outstanding debt was $1.10 billion as of March 30, 2024. A year ago, the firm’s cash and cash equivalents balance stood at $273.60 million.

The firm’s convertible notes were trading at around $0.20 on the dollar earlier this month and the falling stock and bond prices reflect the lack of confidence in the firm’s ability to pay. Interestingly, the latest restructuring comes after the firm’s CFO Lubi Kutua’s remarks in February that it planned to bolster its liquidity and potentially restructure its balance sheet during the year.

As far as the stock price is concerned, the firm has lost more than 89% of its market capitalization since it listed in 2019. On a year-to-date basis, the stock has lost over 12%.

Despite the sell-off in the pre-market session, bulls on Stocktwits believe the restructuring is good news. One user named ‘DisMania’ has compared Beyond Meat’s restructuring news with Carvana before it went on its own epic run. Still, the lingering uncertainty around how the company is going to turn around its core business is weighing on the stock, as fear of further dilution continues.

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)