Advertisement|Remove ads.

Retail Traders Flock To CoreWeave After Citi Upgrade Sparks AI Optimism

CoreWeave Inc. (CRWV) drew a wave of retail attention after Citi upgraded its rating on the cloud infrastructure firm to "Buy," signaling increased confidence in the company’s long-term trajectory.

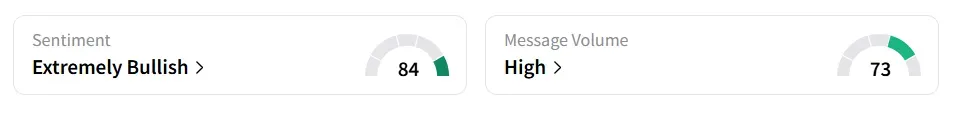

Following the upgrade, CoreWeave stock traded over 13% higher on Thursday morning, after the bell. On Stocktwits, retail sentiment toward the stock jumped to ‘extremely bullish’ (84/100) from ‘neutral’ (73/100) territory the previous day amid ‘high’ message volume levels.

The stock experienced a 127% increase in user message count in 24 hours. A bullish Stocktwits user expressed confidence in the company’s business.

Citi maintained its $160 price target on the stock, as per TheFly.

The firm removed its ‘90-day negative catalyst watch,’ a risk flag it had previously placed on the name.

Following a strong earnings report from Microsoft Corp.(MSFT), Citi noted that CoreWeave’s underlying business strength appears more durable than previously expected.

Citi anticipates the company will benefit from a notable growth uptick starting in 2026. This optimism hinges on the company’s ability to scale contracts and capitalize on a strengthening market for artificial intelligence infrastructure.

Citi acknowledged that short-term volatility may persist, especially with the looming share lockup period expiration on August 15, but the firm appears to view these risks as temporary.

Morgan Stanley analyst Keith Weiss revised the price target on the stock to $91 from $58 while retaining an ‘Equal Weight’ rating.

According to Weiss, the company’s first quarter (Q1) performance exceeded expectations, reflecting sound execution and strong customer demand.

The analyst added that ongoing momentum and upbeat Q1 results could continue to lift forecasts. Still, he warned that the lockup expiration could pressure shares in the short term.

The company has garnered attention in AI and cloud computing circles for its ability to deliver high-performance infrastructure.

CoreWeave stock has gained over 187% since its listing in March.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229385023_jpg_648b095662.webp)