Advertisement|Remove ads.

Confluent, Western Digital, Microsoft Draw Highest Retail Chatter On Stocktwits After Blowout Earnings

The tech-heavy Nasdaq Composite Index closed 0.15% higher at 21,129 on Wednesday, boosted by tech earnings. Confluent, Western Digital, and Microsoft are the top three tech companies that saw the highest retail chatter on Stocktwits in the last 24 hours. Here’s a detailed analysis of how retail responded to the three stocks in the news:

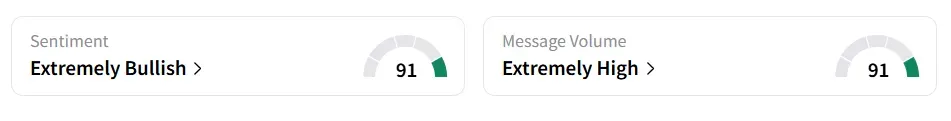

1. Confluent Inc. (CFLT): The data technology platform saw retail chatter surge 2,400% in 24 hours after the company reported better-than-expected second-quarter (Q2) earnings on Wednesday and announced a $200 million investment targeting growth.

Retail sentiment around the stock improved to ‘extremely bullish’ (91/100) from ‘neutral’ territory the previous day. Message volume jumped to ‘extremely high’ (91/100) from ‘high’ levels in the last 24 hours.

The company reported Q2 adjusted earnings per share (EPS) of $0.09 and revenue of $282.3 million, surpassing the analysts’ consensus estimate of $0.08 and $278.4 million, respectively, as per Fiscal AI data.

Confluent stock traded over 27% lower in Thursday’s premarket.

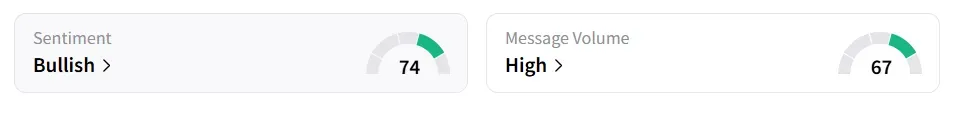

2. Western Digital Corp. (WDC): The data storage company saw retail message count explode by 850% in 24 hours after better-than-expected Q4 earnings on Wednesday.

Retail sentiment around the stock remained in ‘bullish’ (74/100) territory, and message volume improved to ‘high’ (67/100) from ‘normal’ levels in the last 24 hours.

The company reported Q4 adjusted earnings per share (EPS) of $1.66 and revenue of $2.60 billion, surpassing the analysts’ consensus estimate of $1.48 and $2.47 billion, respectively, as per Fiscal AI data.

Western Digital stock traded over 5% higher in Thursday’s premarket.

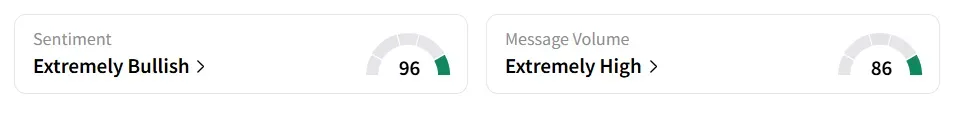

3. Microsoft Corp. (MSFT): The tech behemoth experienced a 723% surge in retail message count in 24 hours after better-than-expected Q4 earnings on Wednesday.

Retail sentiment around the stock remained in ‘extremely bullish’ (96/100) territory, and message volume shifted to ‘extremely high’ (86/100) from ‘high’ levels in the last 24 hours.

The company reported Q4 adjusted earnings per share (EPS) of $3.65 and revenue of $76.441 billion, surpassing the analysts’ consensus estimate of $3.38 and $73,841 billion, respectively, as per Fiscal AI data.

Microsoft stock traded over 9% higher in Thursday’s premarket.

Also See: Sam Altman’s OpenAI Now Rakes In $1B Monthly, Thanks To Explosive ChatGPT User Growth: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_crypto_atm_OG_jpg_5c3f726c93.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ethereum_OG_jpg_57ba235889.webp)