Advertisement|Remove ads.

Retail Turns Bullish After Ross Stores Signals Gains From Tariff Mitigation Strategies

Retail investors' sentiment toward Ross Stores improved Friday as management's assurances on mitigating tariff pressures helped temper concerns over weak earnings and guidance.

Discount store chain Ross Brands, known for its private label clothes and household items, missed revenue expectations for the second quarter and issued weak guidance for the third- and fourth-quarter adjusted earnings per share. Still, the stock rose 2% in extended trading.

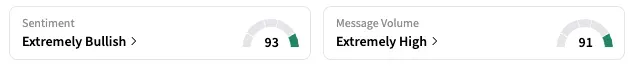

On Stocktwits, the retail sentiment shifted to 'extremely bullish' (93/100) as of early Friday, from the previous day. The message volume was 'extremely high' compared to 'neutral' previously.

User comments were mixed; some noted mistrust for the after-market move and said the stock will fall in Friday's session, while others said the results were better than feared.

On the earnings call, Ross Stores CEO Jim Conroy blamed the additional costs from tariffs for the weak outlook, adding that the company's mitigation strategies were showing results.

"We are confident that we can continue to offset most of the impact of tariffs, but we do anticipate modest pressure in the third quarter, which we expect will be further mitigated in the fourth quarter," Conroy said.

He highlighted the company's efforts in vendor negotiations, diversifying the sourcing mix, and adjusting prices.

Conroy admitted that prices are higher across retailers, but Ross Stores would maintain its "value proposition," as the "off-price sector has historically benefited from disruptions" such as those in the current market.

Ross Stores' stock is up 3.8% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Cracker Barrel's Controversial Logo Change Sparks Criticism, Plummets Shares

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)