Advertisement|Remove ads.

Rhythm Pharmaceuticals Stock Rises On Positive Trial Data From Therapy In Treating Hypothalamic Obesity: Retail, Analysts Get More Bullish

Shares of Rhythm Pharmaceuticals Inc. (RYTM) traded 14% higher on Monday noon after the company announced positive results from a trial of setmelanotide therapy in the treatment of acquired hypothalamic obesity and subsequent price target upgrades.

The biopharmaceutical company announced positive results from its phase 3 trial evaluating setmelanotide, a melanocortin-4 receptor (MC4R) agonist, for treating acquired hypothalamic obesity.

Acquired hypothalamic setmelanotide is a rare form of obesity resulting from damage to the hypothalamus, resulting in accelerated weight gain and insatiable hunger.

The company estimates there are 5,000 to 10,000 people living with hypothalamic obesity in the U.S.

The company said that it observed a statistically significant and highly clinically meaningful reduction in body mass index (BMI) with setmelanotide in both adult and pediatric patients as compared to those administered with a placebo.

CEO David Meeker said that the company is preparing to submit a supplemental New Drug Application to the FDA and a Type II variation request to the European Medicines Agency in the third quarter of 2025.

Bank of America subsequently upgraded the pharmaceutical company’s rating to ‘Buy’ from ‘Neutral’ while also hiking the price target to $63, up from $60.

BofA opined that the company’s setmelanotide is "likely approvable" based on recent data provided by the company.

The recent pullback in the shares offers "additional upside opportunity", the analyst told investors, according to TheFly.

Wells Fargo also raised its price target on the company to $91 from $80 while keeping an “Overweight” rating on the shares.

The firm, which believes that the shares should be trading higher on the trial data, said that the trial results are “solid” and near the bull case.

Wells sees Rhythm trading to over $100 per share by the end of 2025.

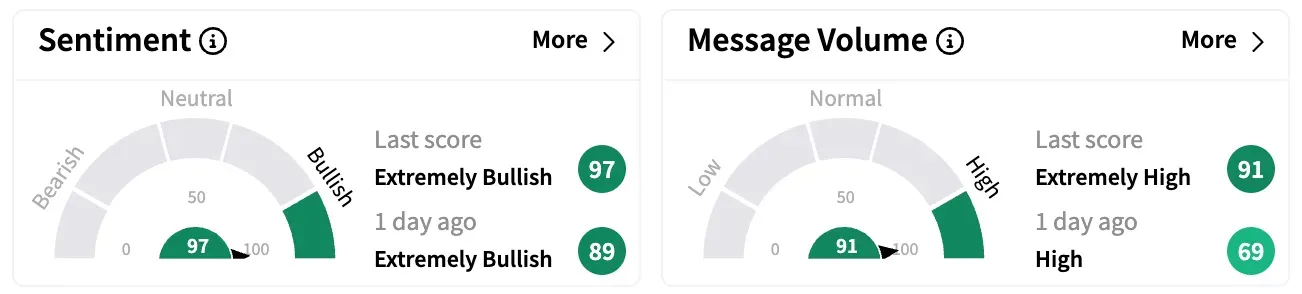

On Stocktwits, retail sentiment about RYTM jumped higher in the ‘extremely bullish’ territory while message volume rose from ‘high’ to ‘extremely high’ levels over the past 24 hours.

RYTM shares are down by over 11% this year but up by nearly 28% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)