Advertisement|Remove ads.

Rivian Stock Dips On Amazon Delivery Van Pause, But Retail Investors ‘Bullish’

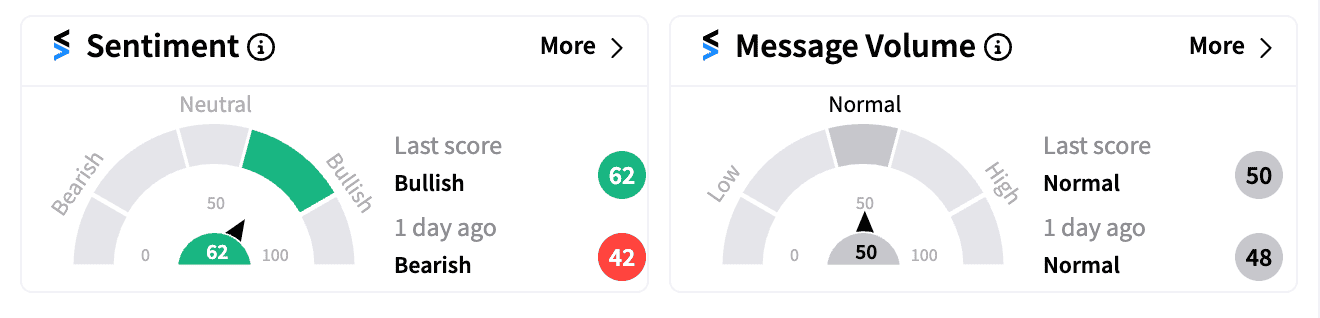

Shares of Rivian Automotive Inc. (RIVN) dipped over 1% on Friday after the company announced a temporary production suspension of its Amazon.com Inc (AMZN) delivery vans due to parts shortages. However, retail investor sentiment on Stocktwits turned ‘bullish’ (62/100) amid normal chatter at the open.

Amazon is Rivian's largest investor and has an order for 100,000 electric delivery vans by the end of the decade. However, Rivian has reportedly assured production of its R1 electric pickup and SUV models continues uninterrupted.

Retail investors seem to be taking a long-term view. Some point to the existing surplus of delivery vans awaiting delivery to Amazon.

Others find solace in a prominent hedge fund's bullish stance and projected price target of $50.

SoMa Equity Partners CIO Gil Simon this week told Bloomberg TV Rivian is “emerging into its promises, being the number two EV player after Tesla in the West. This deal they announced with Volkswagen… is a massive validation of their position.”

In June, Rivian’s stock surged as it revealed a surprise partnership deal with Volkswagen AG (VWAGY), which would give it a cash infusion of as much as $5 billion.

He added that while Rivian’s $13.8 billion market cap is a far cry from Tesla’s, there was a lot of evidence of sales pickup “out on the streets” and reminiscent of Tesla’s rise with the Model S.

Rivian continues to grapple with production issues and a softening electric vehicle market, with shares down over 35% this year.

While it's the second-largest EV producer in the U.S. after Tesla, it faces strong competition, including foreign rivals such as BYD. Still, the Volkswagen tie-up and maintained production of core models offer some hope for retail investors.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2265300941_jpg_bae5290201.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_TMC_CEO_c963fa0b0f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Ui_Path_resized_210dc0332c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_006db9f466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tesla_jpg_2554310f4f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)