Advertisement|Remove ads.

SRx Health Hits Record Low After Eric Jackson Takes Over Crypto Push — Former Peter Lynch Associate Calls It A ‘Sinking Ship’

- The company recently shifted from pet wellness products to a crypto-focused treasury model.

- Shares have extended a multi-session slide following an initial post-deal rally that quickly faded.

- The proposed transaction remains subject to shareholder approval.

Shares of SRx Health Solutions (SRXH) fell to a record low on Tuesday, extending their decline to a fifth straight session, as investors continued to reassess the company’s abrupt shift from pet wellness products to crypto treasury management under activist investor Eric Jackson.

At the time of writing, the stock fell 26% to end at $0.22.

From Pet Wellness To Crypto Treasury

SRx Health, formerly Better Choice Company, rebranded in April and on Dec. 16 announced a definitive agreement to acquire EMJ Crypto Technologies (EMJX). The transaction would pivot the business toward a digital-asset treasury platform that uses artificial intelligence, quantitative models, and systematic risk controls to manage crypto assets.

Upon completion of the reverse merger, Jackson, the founder and chief executive of EMJX, is expected to serve as chairman and CEO of the combined company. The deal, which has been approved by SRx Health’s board, remains subject to shareholder approval and is expected to close in the first quarter of 2026.

Early Rally Fades As Skepticism Grows

The announcement initially sent SRx Health shares sharply higher, with the stock hitting $0.61 at one point, valuing the company at roughly $8.4 million. That rally has since reversed as caution returned to crypto-linked equities, which remain sensitive to swings in bitcoin prices and investor sentiment.

The pullback has come despite fresh announcements from the company, including a Tuesday update that EMJX is expanding its internal risk framework to incorporate data from prediction markets such as Polymarket to better assess regulatory and other tail risks in digital-asset markets.

Former Lynch Associate Voices Concerns

Adding to the pressure, George Noble, a former associate of Peter Lynch, criticized the transaction in a post on X, calling the move “not just a merger, that’s a sinking ship.” Noble pointed to SRx Health’s rapid transition from pet food and wellness products to crypto treasury management and urged the company to consider a reverse stock split, saying it would make the shares easier to short.

A New Crypto Playbook

EMJX aims to differentiate itself from single-asset crypto treasury models by managing a diversified portfolio with active hedging and disciplined capital allocation, rather than relying on dilution or passive exposure.

Jackson is best known in recent years for drawing retail attention to companies such as Opendoor Technologies, helping fuel sharp rallies reminiscent of the 2021 meme-stock era.

How Did Stocktwits Users React?

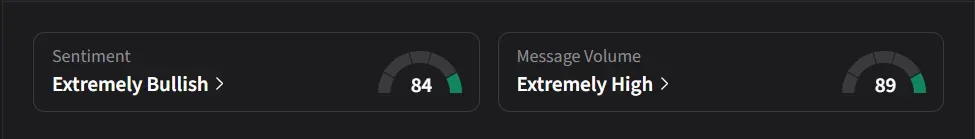

On Stocktwits, retail sentiment for SRx Health was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “Massive things being built. Everyone forget Rome wasn’t built in a day?”

Meanwhile, another user said, “Fire the CEO now!!!”

SRx Health’s stock has declined 26% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)