Advertisement|Remove ads.

SanDisk Stock Soars 17% After-Hours As Q2 Results, Outlook Blow Past Estimates

- SanDisk’s Q3 revenue forecast was 60% higher than Wall Street's consensus target, while the profit target was 150% higher.

- Burgeoning demand from AI data centers is powering the business at memory data store companies.

- SNDK has gained about 1,350% in the past 12 months.

SanDisk Corp.’s shares jumped by over 17% in the extended trading on Thursday, after the flash memory firm posted quarterly results and forecast well above Wall Street’s estimates.

The performance delivered on investors’ high expectations, as burgeoning demand from AI data centers has lifted prospects for memory chip players across the board. SanDisk, in particular, has emerged as one of the market’s standout performers, surging an astonishing 1,350% over the past 12 months.

“This quarter’s performance underscores our agility in capitalizing on better product mix, accelerating enterprise SSD deployments, and strengthening market demand dynamics, all at a time when the critical role that our products play in powering AI and the world’s technology is being recognized,” CEO David Goeckeler said in a statement.

SanDisk forecasts fiscal third-quarter revenue with a midpoint of $4.6 billion and adjusted profit with a midpoint of $14 per share. Both exceeded LSEG/Reuters' estimates of $2.77 billion in revenue and $4.37 per share in profit.

SanDisk manufactures flash memory used in solid-state drives that store vast amounts of data in AI data centers.

The company reported sales and adjusted earnings of $3.3 billion and $6.20 per share for the last quarter, which also beat expectations of $2.64 billion and $3.33 per share.

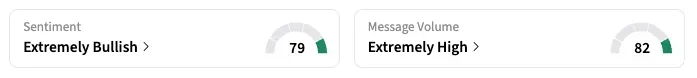

On Stocktwits, retail sentiment for SNDK flipped to ‘extremely bullish’ as of late Thursday, from ‘neutral’ the previous day, amid widespread excitement among users.

“(SanDisk) CEO just said they're super early in the growth cycle. Explosive growth will go on for the foreseeable future. He also said once customers start adopting the Rubin GPU (from Nvidia), growth will go to another level!” a user said.

Notably, SanDisk’s shares have climbed at a rapid clip, doubling the company’s market capitalization to $79 billion in January alone.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: MSFT Stock Posts Worst Day In 6 Years, Drags Broader Market

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)