Advertisement|Remove ads.

Starbucks Downgraded To ‘Sell’ By Redburn Atlantic On Worries Of CEO’s Costly Turnaround Plan: Retail Gets Cautious

Shares of Starbucks Corp. ($SBUX) slipped nearly 1% on Wednesday morning after a bearish note from Redburn Atlantic appeared to have rattled some investors.

The downgrade to ‘Sell’ from ‘Neutral’ came from analyst Edward Lewis, who lowered the price target for Starbucks to $77 from $84, implying a downside of roughly 20% from current levels.

Lewis cited concerns over the high costs associated with new CEO Brian Niccol’s “Back to Starbucks” plan, arguing that the market has yet to fully price in these expenses.

The analyst warned that Starbucks’ current valuation does not account for the financial burden of Niccol’s initiatives, which could weigh on the company’s profitability in the near term.

Earlier this month, Niccol outlined his strategy during his first earnings call as CEO, focusing on streamlining operations and enhancing customer experience.

Key initiatives include reducing the time to serve in-store drinks to four minutes or less, optimizing mobile order efficiency, slowing new store openings, and implementing a more functional store design.

Niccol also aims to simplify drink customization, which has often caused delays in service. He added that the company would shift its focus back to core coffee offerings while exercising more restraint with new menu items.

Despite these ambitious goals, Lewis expressed skepticism about the financial impact. According to him, while company-operated stores have seen annual revenue growth of 7.5% since 2017, store operating expenses have risen by 9.5% per year, eroding profitability.

"We see a similar scenario with the Back to Starbucks plan. With shares trading above a 20-year average price-to-earnings multiple, there is little room for error,” Lewis said.

However, Lewis acknowledged Niccol’s proven track record with turnarounds at Chipotle Mexican Grill Inc. ($CMG) and Taco Bell, suggesting that investors might give him some leeway to implement his strategy.

While he expects Starbucks to return to positive same-store sales in fiscal 2025, he remains cautious on whether this will translate to improved margins.

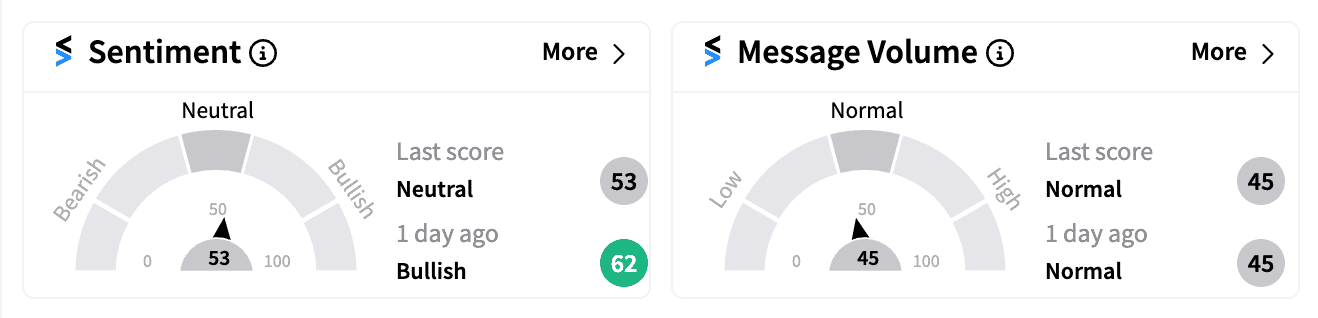

The downgrade quickly drew reactions on Stocktwits, where sentiment for Starbucks flipped to ‘neutral’ on Wednesday morning from ‘bullish’ a day ago.

Retail traders expressed mixed views, with one user questioning if the stock would dip to $95 in response to the downgrade.

Another pointed out that the analysts are starting to acknowledge the cost and time required for the turnaround, adding that the road ahead could be challenging.

Starbucks’ stock is up 2.9% year-to-date, as of the last close, underperforming the S&P 500’s 25% gain over the same period.

For updates and corrections, email newsroom@stocktwits.com

Read next: Bitcoin Miner Hut8 Dazzles Retail On Surprise Q3 Profit, Revenue Surge

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)