Advertisement|Remove ads.

Bessent To Propose Looser Regulation By Financial Stability Monitoring Body Created After 2008 Financial Crisis: Report

- The FSOC was established by Title I of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, following the 2008 financial crisis.

- Bessent’s letter coincides with an FSOC meeting scheduled for Thursday, where the council’s 2025 annual report is slated to be presented and voted on.

- Earlier in October, Bessent criticized the Dodd-Frank legislation, stating that while it was designed to end “Too Big To Fail,” it ended up creating “Too Small To Succeed.”

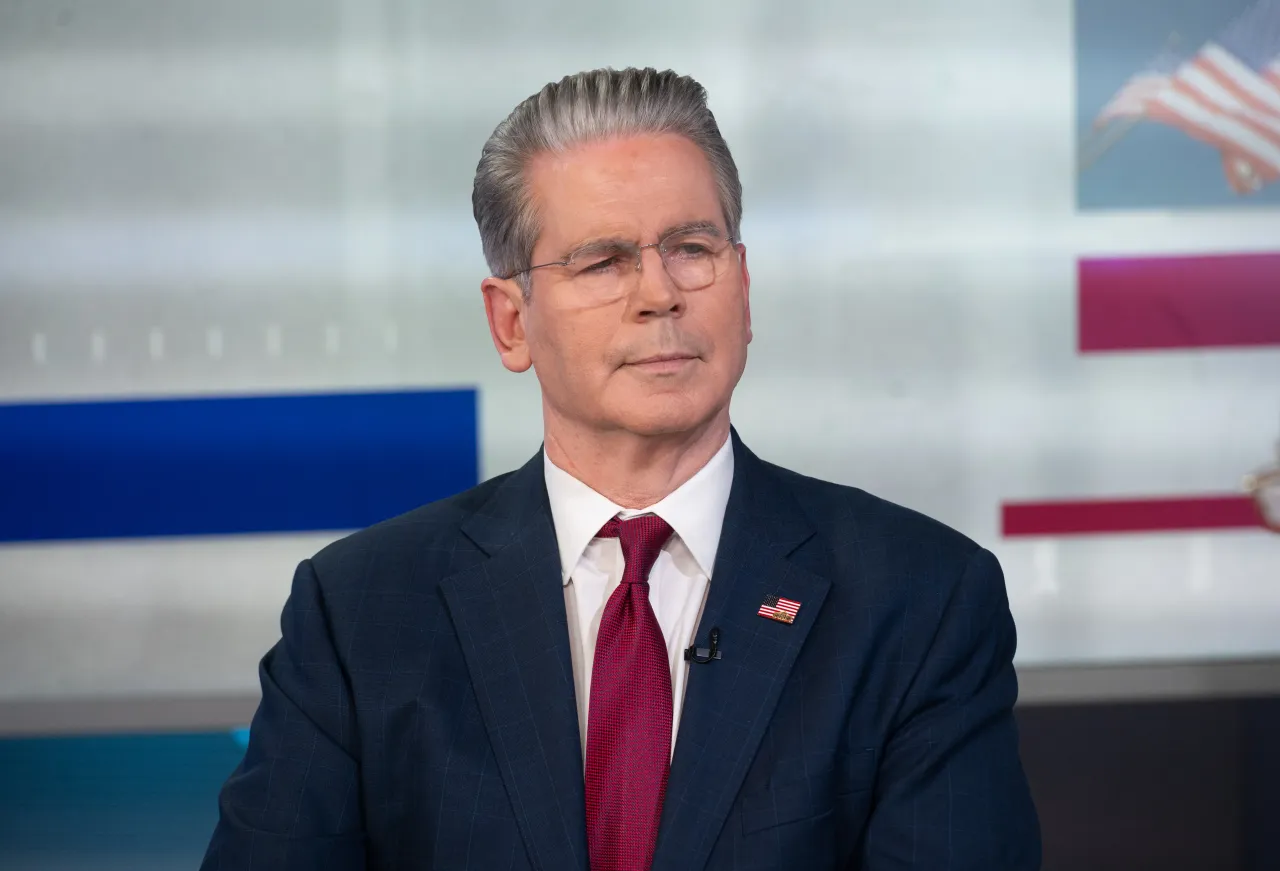

Treasury Secretary Scott Bessent is reportedly gearing up to propose looser regulation by the Financial Stability Oversight Council (FSOC).

According to a CNBC report, Bessent will propose a new approach for the FSOC in a bid to allow the monitoring body to adopt a freer process when it comes to the regulation and oversight of institutions under its mandate.

Bessent is expected to state in his letter that “the Council will work with and support member agencies in considering whether aspects of the U.S. financial regulatory framework impose undue burdens and negatively impact economic growth, thereby undermining financial stability,” according to the report.

The FSOC was established by Title I of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, following the 2008 financial crisis.

AI To Improve Resilience

The report also added that Bessent is forming a working group to explore ways in which artificial intelligence technology can be used to improve the resilience of the United States’ financial system. In addition to this, the Treasury Secretary will also task the group with monitoring potential risks to the financial stability of the U.S. arising from the adoption of AI.

Bessent’s letter coincides with an FSOC meeting scheduled for Thursday, where the council’s 2025 annual report is slated to be presented and voted on.

Bessent’s Criticism

Earlier in October, Bessent criticized the Dodd-Frank legislation, stating that while it was designed to end “Too Big To Fail,” it ended up creating “Too Small To Succeed.”

The legislation was sponsored by Sen. Christopher J. Dodd (D-Conn.) and Rep. Barney Frank (D-Mass.).

Fed Governor Michael Barr previously expressed concerns with the central bank’s deregulation proposal on capital standards, which regulators appointed by President Donald Trump have supported.

Meanwhile, U.S. equities were mixed in Thursday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.59%, the Invesco QQQ Trust ETF (QQQ) declined 0.82%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose 0.96%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up by 0.2% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)