Advertisement|Remove ads.

Shopify Stock Gets Downgraded By Phillip Securities As Valuation Concerns Loom, But Retail Stays Exuberant

Shopify Inc.'s (SHOP) stock has surged over 24% in the past month, but not all Wall Street analysts seem absolutely gung-ho about it.

According to The Fly, Phillips Securities analysts downgraded shares of the e-commerce platform to ‘Accumulate’ from ‘Buy,’ days after the e-commerce company’s fourth-quarter (Q4) earnings beat Wall Street expectations.

The brokerage’s downgrade contrasts a wave of price target hikes after Shopify’s Q4 results, as it cited valuation concerns.

Phillips noted that Shopify is currently performing at its peak, posting a seventh consecutive quarter of revenue growth. The company’s gross merchandise value (GMV), which crossed the $1 trillion mark during the fourth quarter, grew at the fastest pace since the surge after the Covid-19 pandemic in FY21’s fourth quarter.

In a similar vein, analysts at Jefferies also underscored that the stock is currently at a “premium valuation,” according to The Fly.

Another likely reason behind Phillip Securities’ downgrade is Shopify’s relatively rich valuation compared to sector peers.

On a trailing twelve-months (TTM) basis, Shopify’s price-to-earnings (PE) ratio stood at 82.8, while Workday's is at 42.8 and Salesforce’s is at 53.8, according to Koyfin data.

Analysts from Morgan Stanley, JPMorgan, UBS, Oppenheimer, and other brokerages raised their price targets for the Shopify stock, noting that the e-commerce company posted a solid beat on the back of a “broad set of growth drivers.”

To recall, Shopify’s Q4 earnings per share (EPS) stood at $0.44, beating an estimated $0.43. Its revenue of $2.8 billion also came in ahead of an estimated $2.73 billion.

The company guided for a 2% rise in fiscal year 2025 revenue, citing strength in growth levers such as subscription and merchant solutions.

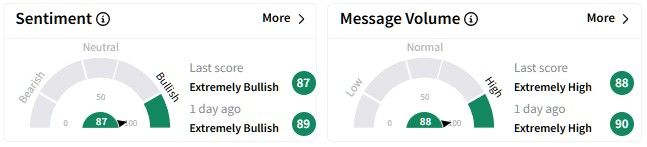

On Stocktwits, retail sentiment around the Shopify stock remained exuberant, staying in the ‘extremely bullish’ (87/100) territory. Message volumes were also in the ‘extremely high’ levels at the time of writing.

One user posted a technical analysis of the Shopify stock, underscoring their bullish outlook.

Shopify’s share price has surged by nearly 71% over the past six months, but its one-year returns are slightly less impressive at 63%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)