Advertisement|Remove ads.

SLB CEO Highlights Customer Caution In Offshore Deepwater Market: But Retail Bulls Hold Steady

SLB (SLB) CEO Olivier Le Peuch stated on Friday that customers are selectively adjusting their activities, prioritizing key projects, and planning cautiously, particularly in offshore deepwater markets.

SLB shares rose 1.4% in premarket trading after the company beat quarterly profit expectations on Friday, helped by steady demand in some of its international business, mainly in the Middle East, like the U.A.E., Asia, and Europe.

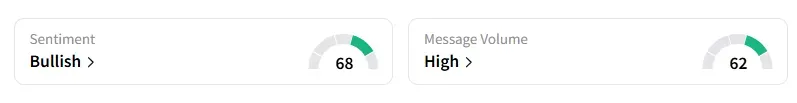

Retail sentiment on the stock trended in the ‘bullish’ territory with chatter at ‘high’ levels, according to Stocktwits data. Over the last seven days, leading up to the earnings announcement, message count on Stocktwits saw a 300% increase.

SLB is observing a more nuanced approach from customers, as the recent decline in crude prices has heightened concerns about a broader pullback in exploration and production spending.

This is weighing on demand for oilfield services, particularly in deepwater drilling, a capital-intensive and high-risk segment that is especially sensitive to macroeconomic conditions.

"The market is navigating several dynamics — including fully supplied oil markets, OPEC+ supply releases, ongoing trade negotiations and geopolitical conflicts,” Le Peuch said.

He added that the upstream market has remained relatively resilient.

In the North American market, SLB experienced strong growth in data center infrastructure solutions; however, this growth was largely offset by reduced Asset Performance Solutions revenue in Canada and a sharp decline in U.S. land drilling activity.

SLB’s second-quarter adjusted profit came in at $0.74 per share, compared with Wall Street expectations of $0.73, according to data compiled by Fiscal AI.

The total revenue for the quarter decreased 6% to $8.55 billion, compared with estimates of $8.50 billion.

The stock has lost nearly 10% year-to-date and has fallen over 30% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)