Advertisement|Remove ads.

SLB’s $8B ChampionX Merger Crosses Final Regulatory Barrier With UK Approval, Retail Still Bearish

The U.K.’s Competition and Markets Authority has approved SLB’s (SLB) $8 billion acquisition of ChampionX after accepting assurances aimed at resolving antitrust concerns, paving the way for the deal to close on Wednesday.

SLB shares were down 2.6% during midday trading.

The deal had faced issues with the CMA after it raised concerns about reduced competition in production chemicals and oilfield automation. To avoid a deeper Phase 2 investigation, SLB and ChampionX offered divestment of SLB’s U.K. production chemicals business and commercial remedies for ChampionX’s Quartzdyne business, including long-term supply agreements and IP licensing.

The U.K.’s competition regulator said it proposes to accept the deal based on the commitments made by the companies, rather than proceeding with a Phase 2 investigation.

SLB, formerly known as Schlumberger, announced its decision to buy ChampionX in April 2024, through an all-stock transaction. The deal was unanimously approved by ChampionX’s board and included a share exchange ratio of 0.735 SLB shares for each ChampionX share.

The deal helps strengthen SLB’s position in the production space by combining ChampionX’s expertise in production chemicals and artificial lift technologies with SLB’s global reach and digital capabilities.

In April, the Norwegian Competition Authority also accepted SLB’s proposals to gain merger clearance, including a previously announced sale of ChampionX’s U.S. Synthetic polycrystalline diamond (PCD) bearings business.

Last year, U.S. regulators also cleared the deal.

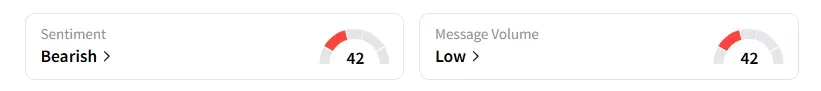

Retail sentiment on SLB was in the ‘bearish’ territory, compared to ‘neutral’ a day ago, with message volume at ‘low’ levels, according to data from Stocktwits.

SLB’s shares are down nearly 8% year-to-date and declined over 27% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Dave & Buster’s Names Former KFC Executive Tarun Lal As New CEO, But Retail’s Not Excited Yet

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)