Advertisement|Remove ads.

SMCI Stock Crashes Over 27% After Firm Delays Filing Of Annual Report: Retail Sentiment Hits One-Year Low

Server-maker Super Micro Computer, Inc (SMCI) lost more than a quarter of its market capitalization on Wednesday after the company announced a delay in the filing of its annual report on Form 10-K for the fiscal year ending on June 30, 2024.

The firm said it expects to file a notification of late filing on Form 12b-25 with respect to the annual report.

“SMCI is unable to file its Annual Report within the prescribed time period without unreasonable effort or expense. Additional time is needed for SMCI’s management to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting as of June 30, 2024,” the company said in a release.

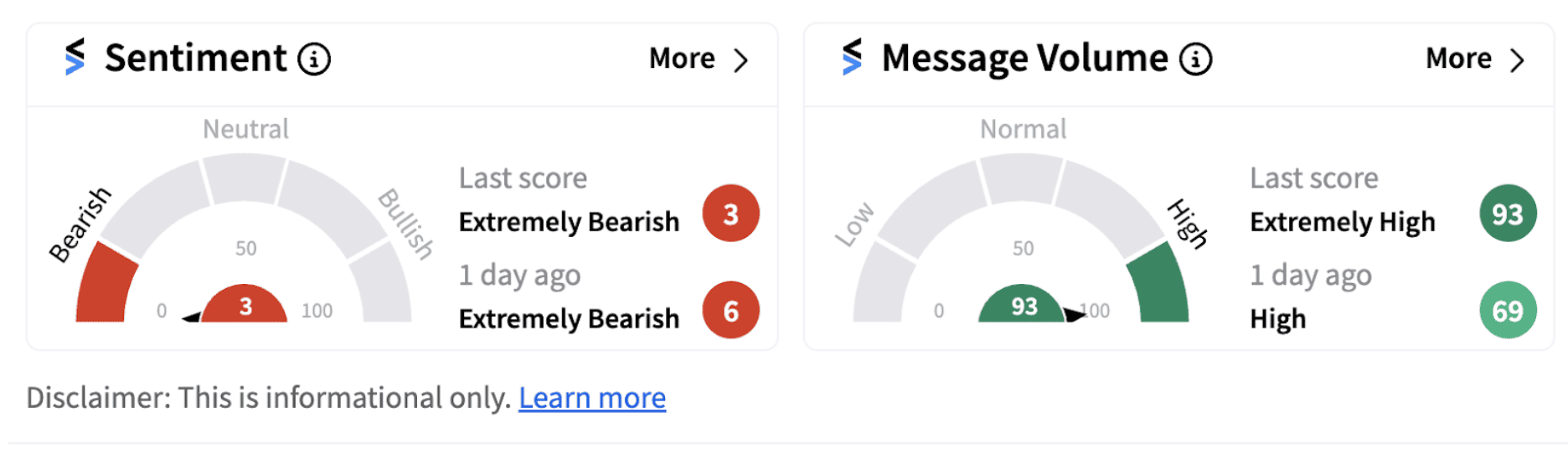

Following the disclosure, retail sentiment on Stocktwits dipped further into the ‘extremely bearish’ territory (3/100), hitting a one-year low. The move was accompanied by ‘extremely high’ message volumes.

Retail investors on Stocktwits are disappointed with the company’s announcement.

Notably, the firm’s decision to delay its annual report comes after Hindenburg Research’s disclosure of a short position on the stock.

The short-seller said on Tuesday it has fresh evidence of accounting manipulation, sibling self-dealing and sanctions evasion by the firm. Hindenburg Research said its three-month investigation into the company found glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.

Hindenburg also said that less than three months after paying a $17.5 million SEC settlement, Super Micro began re-hiring top executives that were directly involved in the accounting scandal, according to litigation records and interviews with former employees. It cited a former employee saying “almost all of them are back. Almost all of the people that were let go that were the cause of this malfeasance.”

The short-seller’s report argued that exports of Super Micro’s high-tech components to Russia have spiked approximately 3x since the invasion of Ukraine, “apparently violating U.S. export bans,” according to its review of more than 45,000 import/export transactions.

Meanwhile, JPMorgan analysts reportedly said some of Hindenburg’s claims are “tough to verify.” They believe that the report is “largely void of details around alleged wrongdoings from the company,” according to a CNBC report.

Despite the meltdown in the stock price on Wednesday, SMCI stock is still up over 42% on a year-to-date (YTD) basis.

Also See: Kohl’s Stock Jumps As EPS Smashes Expectations, Full-Year Outlook Brightens: Retail Sentiment Soars

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)