Advertisement|Remove ads.

SMCI’s Strong Q2 Performance Draws Mixed Signals From Wall Street — Here’s What Analysts Are Saying

- Tim Long of Barclays lowered his price target for Super Micro to $38 from $43 while maintaining an ‘Equal Weight’ rating.

- Needham trimmed its price target to $40 from $51 but kept a ‘Buy’ rating.

- Needham emphasized that the lower target reflects a compression of multiples across the AI hardware market.

Super Micro Computer Inc. (SMCI) is experiencing a mix of analyst reactions after posting significant revenue growth in its fiscal second quarter (Q2). While sales surged due to large-scale customer deployments, margin pressures and sector-wide trends in AI hardware have prompted multiple firms to adjust their price targets.

The company’s Q2 net sales came in at $12.7 billion with earnings per share (EPS) of $0.69. Both the metrics surpassed the analysts’ consensus estimate of $10.34 billion and $0.49, respectively, according to Fiscal AI data.

Analysts Adjust Price Target

Tim Long of Barclays lowered his price target for Super Micro to $38 from $43 while maintaining an ‘Equal Weight’ rating, noting that Q2 revenue more than doubled from the prior quarter, according to TheFly.

The increase was fueled by accelerated deployments among major clients, although gross margins tightened as expected, he added.

Meanwhile, Needham trimmed its price target to $40 from $51 but kept a ‘Buy’ rating. The firm highlighted that strong earnings stemmed from a major customer expanding its data center footprint, while Super Micro’s DCBBS – Data Center Building Block Solutions, gained traction with key clients.

However, Needham emphasized that the lower target reflects a compression of multiples across the AI hardware market.

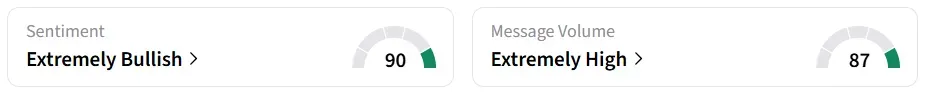

Super Micro stock traded over 12% higher on Wednesday morning. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Mizuho Maintains Neutral Outlook

Mizuho analyst Vijay Rakesh raised the price target slightly to $33 from $31 and maintained a ‘Neutral’ rating, citing robust results but persistent challenges from competition and margin pressure.

Super Micro’s performance highlights the dual forces affecting the AI and data center sectors: strong adoption of specialized offerings like Data Center Building Block Solutions (DCBBS) alongside margin pressures from supply and pricing shifts.

SMCI stock has gained over 13% in the last 12 months.

Also See: AMD CEO Says 2026 Will Be A Major ‘Inflection Year,’ Fueled By AI-Driven CPU Demand

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)