Advertisement|Remove ads.

SML Isuzu Shares Hit Lower Circuit As Mahindra's Buyout Bid Fails To Cheer Investors

SML Isuzu stock plunged over 10% in Monday's session, hitting a lower circuit after Mahindra & Mahindra (M&M) announced plans to acquire a majority stake in the company. In contrast, M&M's stock gained about 2%.

Over the weekend, M&M said it would acquire a 58.96% stake in SML Isuzu for ₹555 crore by purchasing 43.96% from Sumitomo Corporation and 15% from Isuzu Motors at ₹650 per share.

In line with SEBI regulations, M&M will also launch a mandatory open offer to acquire up to 26% of SML's shares at ₹1,554.6 per share.

Notably, the open offer price is at a steep 13% discount to SML's Friday closing price of ₹1,789, dampening investor sentiment and triggering a sell-off.

SML Isuzu is a notable player in the intermediate and light commercial vehicle (ILCV) space, particularly in buses, where it commands a 16% market share.

M&M aims to bolster its commercial vehicle (CV) portfolio through this acquisition.

Currently, M&M holds a 3% market share in this category, which it plans to double immediately after the acquisition.

Over the long term, the company targets a 10%–12% market share by FY31 and over 20% by FY36.

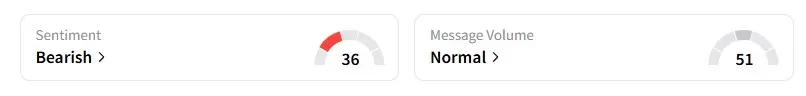

On Stocktwits, retail sentiment for SML Isuzu remains 'bearish.'

For the year, however, SML Isuzu stock has gained 14%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)