Advertisement|Remove ads.

SOFI Stock Selloff Is Overdone, Says Citizens As It Sets $30 Target

- Citizens upgraded SoFi stock to Outperform from Market Perform and set a $30 price target.

- Analyst Devin Ryan attributed the recent selloff in the stock to shifting investor preferences that have weighed on high-growth names.

- In the fourth-quarter fiscal 2025, SoFi said that it recorded its biggest-ever quarterly growth in both customers and products.

Citizens upgraded SoFi Technologies Inc. (SOFI) stock to Outperform from Market Perform and set a $30 price target, reframing the fintech’s recent slump as a buying window rather than a warning sign.

Analyst Devin Ryan stated the stock’s pullback masks improving fundamentals, according to TheFly.

SoFi Technologies’ stock traded over 4% higher in Monday’s premarket.

Growth Rotation Hit SoFi Harder Than Peers

SoFi shares recently traded near $21, a notable retreat after topping $30 late last year. The stock is down about 20% so far this year, a move Ryan attributes less to company-specific issues and more to shifting investor preferences that have weighed on high-growth names.

According to the analyst, the broader market’s move away from growth-oriented stories has pressured SoFi disproportionately. Ryan said the decline reflects technical factors and compressed valuation multiples rather than concern about near-term economic conditions.

‘Compounding At Scale’ Supports Bull Case

Citizens highlighted SoFi’s ability to expand efficiently as a key reason for the upgrade. The firm pointed to what it described as “compounding at scale,” noting that the company continues to broaden its revenue mix beyond lending into fee-driven and capital-light products.

In the fourth-quarter fiscal 2025, SoFi said that it recorded its biggest-ever quarterly growth in both customers and products. The company added about one million new members during the period, lifting its total membership to 13.7 million, a 35% year-on-year (YoY) increase. The number of products used by customers also rose sharply, climbing 37% YoY to reach 20.2 million.

What Is The Retail Mood On Stocktwits?

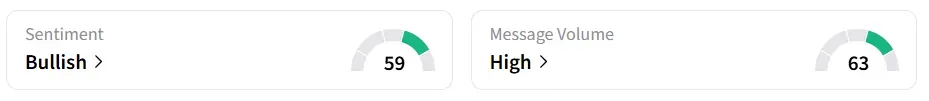

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume.

SOFI stock has gained over 37% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)