Advertisement|Remove ads.

Solara Stock In Pause Mode Before Next Move? SEBI RA Vijay Gupta Sees Healthy Setup

Solara Active Pharma shares have rallied 25% in the last one month. According to Vijay Kumar Gupta, a SEBI-registered analyst, the stock is now consolidating near a critical resistance zone after a decisive breakout.

Its momentum looks healthy, supported by solid volumes and improving fundamentals, he added.

On the technical charts, it is trading above Ichimoku cloud with a bullish bias. The price action is hovering in the Fair Value Gap zone, yet to clear its upper resistance.

Gupta also noted that its Commodity Channel Index (CCI) stands near 98, indicating moderate bullish momentum without overextension.

TTM Squeeze (a technical indicator that identifies periods of low volatility) shows fading histogram bars, indicating that the stock may experience a possible pause before a fresh move. Additionally, the volume consolidation suggests healthy digestion of gains.

Fundamentally, Solara is one of India’s leading API manufacturers, focusing on chronic therapy segments like pain management and inflammation.

Recent performance has been boosted by operational turnaround and restructuring efforts following its merger phase. It reported a 15% revenue growth in the March quarter, which also saw its profits tripling to ₹41 crore. Gross margins have expanded significantly due to better product mix. Going ahead, its debt reduction and working capital efficiency remain key positives.

Gupta also noted that the management commentary hinted at stronger export orders and improved utilization in FY26.

What’s Driving The Sentiment?

According to Gupta, investor interest is returning in niche pharma plays, driven by financial deleveraging and margin expansion. Additionally, the global focus on API de-risking by clients is benefiting Indian manufacturers.

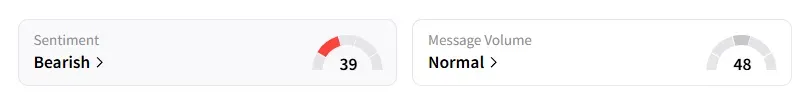

However, data on Stocktwits shows that retail sentiment has been ‘bearish’ on this counter for a few weeks.

Solara shares have declined 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_corning_HQ_resized_jpg_cd127e7be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amd_jpg_c1e6ad7ae9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AI_chip_representative_image_jpg_ab73461e0d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_home_depot_resized_jpg_41f1dc8f5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260490321_1_jpg_e83ecbf5cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)