Advertisement|Remove ads.

Soundhound AI Stock Slips Deeper Post Earnings: Analyst Turns Bearish, But Retail Hangs Tight

Shares of SoundHound AI, Inc. ($SOUN) dropped more than 15% on Wednesday, on track for a second consecutive session in the red after the company reported its quarterly results.

SoundHound reported adjusted third-quarter (Q3) loss per share of $0.04, better than a feared loss of $0.07 per share, while revenue of $25.1 million was better than an expected $23.02 million.

Research firm Ladenburg on Wednesday reportedly downgraded SoundHound to ‘Neutral’ from ‘Buy,’ maintaining a price target of $7.

The downgrade came despite the company’s strong earnings, with the recent acquisition of Amelia, a private company, expected to help SoundHound expand into larger enterprises and new verticals, boosting its scale.

However, the analyst expressed concerns about the near-term impact of the acquisition, specifically regarding the absorption of its losses and the stock’s rapid price increase, which may have led to overvaluation.

SoundHound reported third-quarter earnings that exceeded Wall Street’s expectations, alongside a positive outlook.

CEO Keyvan Mohajer emphasized that the company was in its largest quarter on record, marking the start of its expansion into important new verticals.

The company sees voice technology as the “killer app” for applied generative AI, leveraging its AI-driven software to capture significant market share in this growing space.

However, these developments weren’t enough to sustain the momentum from the stock’s recent rally. Shares had surged 33% in the past five days before Tuesday’s close, leading some investors to take profits.

The stock got a major boost earlier this year when Nvidia revealed an investment in SoundHound, acquiring around 1.7 million shares, or a 0.5% stake.

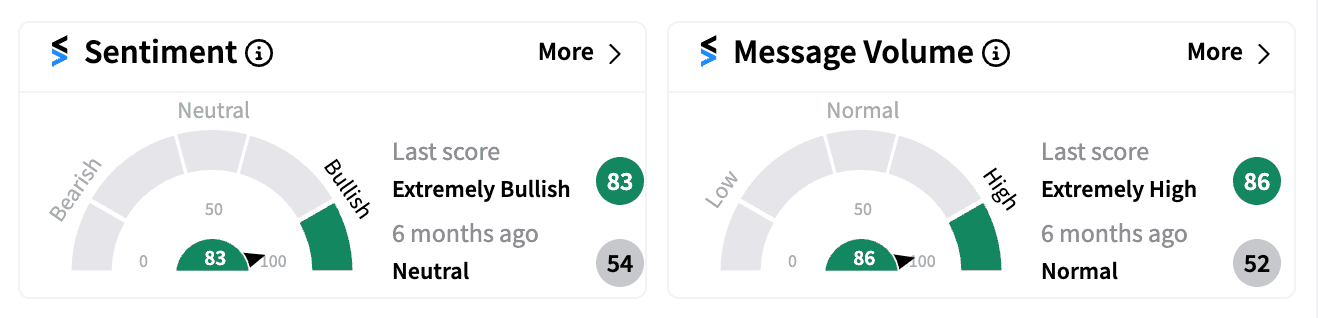

On Stocktwits, retail sentiment flipped from ‘neutral’ to ‘extremely bullish’ on Wednesday. Message volume spiked nearly 77% in the previous session in anticipation of the results.

SOUN’s retail following has grown by more than 250% in the past year, and the stock has more than tripled in value in 2024, outperforming major indices.

Despite the analyst downgrade, retail investors appear confident in SoundHound’s long-term potential.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)